Share to ...

Copy Link

Famgram.********ineroyal | 21K followers telegram account

37 months aged

@********ineroyal

Followers

21K

Posts

80

Price(USD)

$250

Category

Crypto

Date of Joined

Jan 2023

Date of Last Post

Jan 5, 2026

Last 36 posts

texts

0

Pictures

79

Videos

0

audios

0

documents

0

animations

0

Last 36 posts

Averages

Views

5.6K

Post/Per Month

0

listing.TotalReactions

Total

1.7K

Post/Per Month

Besties

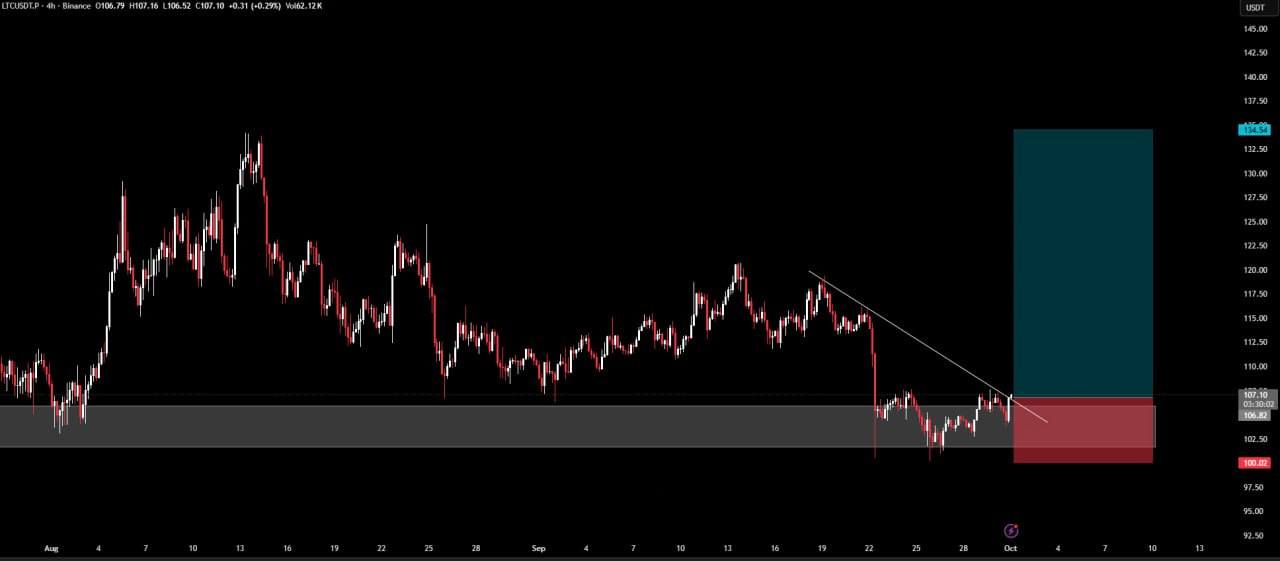

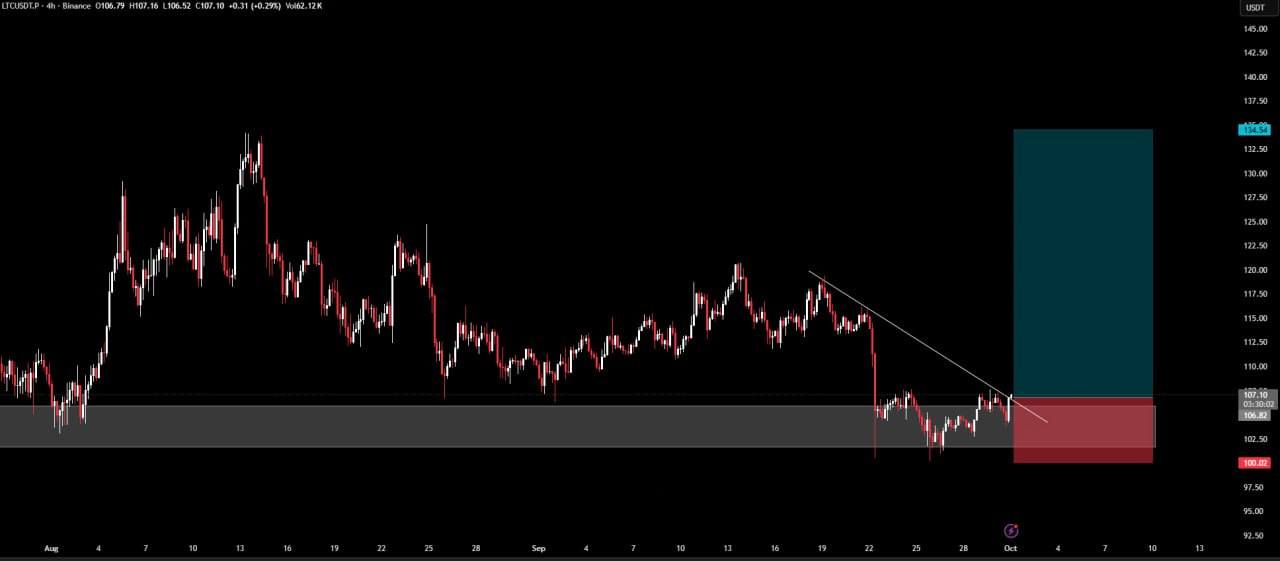

𝗟𝗧𝗖/𝗨𝗦𝗗𝗧 𝗠𝗔𝗥𝗞𝗘𝗧 𝗔𝗡𝗔𝗟𝗔𝗬𝗦𝗜𝗦 🚀 #LTC is showing bullish momentum after defending key support, with buyers maintaining control and forming a steady upward structure as price attempts to break into higher ranges. If this strength continues, LTC could move toward the 107.5–112 region, with extended upside potential while price remains above 100. #ltc #update

13

10

10

9.5K

1

Top 10 Hashtags

Description

🔥🔥🔥🔥 CONTACT ME ON TELEGRAM @BAWRA FOR MORE CHANNELS 🔥🔥🔥🔥

Last Posts

Bitcoin Fear and Greed Index Drops to 2-Month Low The index was in a greedy state until recently, but the landscape has changed. The cryptocurrency industry experienced its own set of failures last year when numerous internal companies and projects imploded, resulting in declining prices, countless bankruptcy filings, and, somewhat expectedly, lots of investor losses. The first several weeks of 2023 saw BTC finally overcoming $17,000, which propelled a mini bull run that drove the asset to and beyond $25,000 in February.

10

6

3

84

Ankr And Tencent Cloud Join Forces To Disrupt Web3 Infrastructure Space Ankr has recently announced a partnership with Tencent Cloud to provide a new service that caters to thousands of apps, games, virtual worlds, and companies requiring reliable connections to blockchain data. They will introduce a series of blockchain API services and a Metaverse-in-a-Box product to help Web3 developers.

11

5

3

109

Terraform Labs CEO Do Kwon believed to be arrested in Montenegro, Yonhap says A person suspected to be Do Kwon, founder of the Terra blockchain that collapsed in spectacular fashion last year, has been arrested in Montenegro, Yonhap reported, citing South Korean police.

12

5

2

215

MicroStrategy adds to massive bitcoin bet, takes total to 140,000 BTC MicroStrategy acquired an additional 1,045 bitcoin worth around $29.3 million, it revealed on Wednesday. MicroStrategy shares have risen 105% year-to-date, while bitcoin is up over 72%. Shares in the firm are viewed by some as a proxy for investing in bitcoin due to its large exposure to the digital asset. MicroStrategy was up 1.3% in pre-market, trading around $303.

9

6

4

221

TUSD Gains The Upper Hand On Binance, Becoming The Largest BTC Trading Pair According to data source Kaiko, TrueUSD (TUSD), a stablecoin that was poorly known before this year, is now the biggest Bitcoin trading pair, thanks to the Binance crypto market, Bloomberg reported. According to data source Kaiko, TrueUSD (TUSD), a stablecoin that was poorly known before this year, is now the biggest Bitcoin trading pair, thanks to the Binance crypto market, Bloomberg reported.

10

5

4

238

Chainlink Labs And StarkWare Collaborate To Increase StarkNet’s Capabilities To increase app development on its decentralized Layer 2 zk-Rollup network, StarkNet, Ethereum scaling company StarkWare has joined forces with blockchain oracle developer Chainlink Labs. which supports over $7 trillion in transaction volume and has about 725,000 active users, is the most popular in DeFi.

14

3

2

240

Stellar Foundation Listed In Genesis Top Creditors List With $13 Million Claim The largest creditors of Genesis, the troubled cryptocurrency lending behemoth that applied for bankruptcy protection, were listed by the charity Stellar Foundation. described the amount as “immaterial” in light of the remainder of its funds’ reserves. Genesis has $3.5 billion in debt to its top 50 creditors, which includes the Stellar Foundation, according to bankruptcy documents.

9

6

4

261

Ether (ETH) Stored on Centralized Exchanges Hits 5-Year Low: Data Ether balance on the centralized crypto exchanges has reached a five-year low. According to the latest data from Glassnode, there are currently 17.8 million ETH on exchanges – a level not seen since July 2016.

10

6

3

342

Worldcoin Migrates to Optimism Worldcoin, the biometric decentralized identity and wallet protocol, has announced it has completed the migration process to switch its operations from Polygon to Optimism, an Ethereum L2 scaling layer.

12

4

3

367

Massive Token Withdrawal: Over $3.7 Million Worth Of WLD Withdrawn From Binance And OKX 1 hour ago, an address withdrew a total of 2.5 million WLD from Binance and OKX, equivalent to about 3.7 million USD. In a significant move that has caught the attention of the crypto community, an address has successfully withdrawn a substantial amount of Worldcoin tokens from both Binance and OKX, totaling a staggering 2.5 million WLD.

10

6

3

384

Aave DAO Approves Proposal To Acquire 443,674 AURA From Olympus DAO Aave DAO’s ARFC proposal for the acquisition of 443,674 AURA at a total cost of 420,159.28 DAI units was approved with an approval rating of 83.69%. Olympus DAO seeks payment in DAI, with an exchange rate of 0.9470 DAI per AURA unit (approximately the current market price).

11

5

3

456

Spot Bitcoin ETF Approvals Could Add $1 Trillion to Crypto Market Cap, CryptoQuant Says Bitcoin will become a $900 billion asset, and the total crypto market will grow by $1 trillion, should the bitcoin spot exchange-traded funds (ETFs) be approved, data analytics firm CryptoQuant wrote in a recent report.

11

6

2

477

Vitalik Buterin has transferred over 1.8k ETH to exchanges this year, still holds over 250k ETH On-chain data shows that Ethereum co-founder Vitalik Buterin transferred 400 ETH, approximately $630,000, to Coinbase earlier today. According to the Arkham Intelligence dashboard, the transfer continues a recent trend of transactions within the last seven days that has seen Buterin transfer more than 1,000 ETH, including today’s transaction, to exchanges, unknown addresses, and a Gnosis Safe Proxy wallet.

10

6

3

484

Bitcoin spot ETF anticipation fuels largest crypto fund inflows for two years: CoinShares Crypto fund inflows at asset managers such as 21Shares, CoinShares, Bitwise, Grayscale and ProShares added $346 million last week, the largest jump since the bull market of late 2021, according to CoinShares’ latest report. Last week's addition nearly doubled the $176 million registered in the prior week, compounding a nine-week consecutive run and bringing year-to-date inflows to over $1.5 billion.

9

6

4

518

Tuttle Capital's Crypto Odyssey: Unveiling Six Powerhouse Bitcoin ETFs for a Revolutionary Investment Experience! In a move set to reshape the crypto investment landscape, Tuttle Capital Management has boldly entered the arena by filing three N1-A forms with the Securities and Exchange Commission (SEC). Their mission? To introduce not just one or two, but a total of six groundbreaking Bitcoin ETFs that promise to redefine the way investors navigate the world of cryptocurrencies.

10

6

3

598

Ethereum price increase driven by anticipation of Dencun upgrade: Grayscale While many market watchers might be attributing Ethereum's recent price increase to optimism stemming from the possible approval of a spot ether ETF, asset manager Grayscale Investments has suggested that the cryptocurrency rose in value because of Ethereum's upcoming Dencun upgrade, which will increase the throughput and reduce the cost of some transactions on the network.

10

5

4

604

FTX plans sale of Digital Custody for $500K in bankruptcy move The FTX debtors estate, led by CEO John Ray III, has filed to sell Digital Custody to CoinList for a significant markdown of $500,000, with financing provided by DC’s original CEO and seller, Terence Culver. FTX initially purchased Digital Custody for $10 million.

8

6

5

612

Spot bitcoin ETF holdings on track to surpass GBTC today The nine recently approved spot bitcoin exchange-traded funds in the United States are on track to surpass the Grayscale Bitcoin Trust's holdings today.

11

5

3

615

GBTC Experiences Its Largest Daily Drain Yet, Nearly 239,000 BTC Gone in Under 70 Days According to the latest statistics, Grayscale’s Bitcoin Trust (GBTC) experienced its most significant outflow on March 18, 2024, totaling $643 million.

10

6

3

711

𝗢𝗡𝗧/𝗨𝗦𝗗𝗧 𝗠𝗔𝗥𝗞𝗘𝗧 𝗔𝗡𝗔𝗟𝗬𝗦𝗜𝗦 🚀 #ONT is building strength above the 0.3239–0.3686 support zone, forming a steady bullish structure as buyers continue to absorb sell pressure. Momentum is gradually shifting upward, indicating growing interest at the base. If ONT maintains support and breaks the immediate resistance band, price could extend toward higher levels while protecting the 0.3106 invalidation. #ont #update

10

5

4

724

1

Google now allows wallet address searches for Bitcoin, Fantom, Arbitrum and others Google now allows users to search balances of wallets on Bitcoin, Arbitrum, Avalanche, Optimism, Polygon and Fantom blockchain. The search results when typing in wallet addresses display the remaining token balance in the wallet per network and the time the balance was last updated.

10

6

3

733

𝗪𝗫𝗣/𝗨𝗦𝗗𝗧 𝗠𝗔𝗥𝗞𝗘𝗧 𝗔𝗡𝗔𝗟𝗬𝗦𝗜𝗦 🚀 #WXP is building strength inside the 0.074–0.086 demand zone, where buyers have shown repeated interest. The structure is tightening, signaling a potential bullish continuation if the upper band breaks. A push above short-term resistance could trigger momentum toward higher liquidity levels, while 0.069 remains the key invalidation for this setup. #wxp #update

12

4

3

741

𝗦𝗘𝗜/𝗨𝗦𝗗𝗧 𝗠𝗔𝗥𝗞𝗘𝗧 𝗔𝗡𝗔𝗟𝗬𝗦𝗜𝗦 🚀 #SEI is trading inside the 0.69–0.735 accumulation range, where buyers have consistently stepped in to defend structure. Momentum is slowly building, suggesting early signs of bullish pressure returning. A breakout above short-term resistance could open continuation toward upper liquidity levels, while 0.66 remains the key invalidation for this setup. #sei #update

10

6

3

772

After Halving Event, Bitcoin Transaction Fees Soar to Over $240 Upon reaching block height 840,000, when the mining pool Viabtc collected 37.626 bitcoin in fees worth $2.39 million, the expense for onchain transfers climbed, surpassing $240 per transaction. Block 840,003 recorded 16.06 bitcoins in fee payments, and block 840,004 accumulated 24 bitcoins in fees valued at over $1.5 million.

10

4

4

864

𝗥𝗘𝗤/𝗨𝗦𝗗𝗧 𝗠𝗔𝗥𝗞𝗘𝗧 𝗔𝗡𝗔𝗟𝗬𝗦𝗜𝗦 🚀 #REQ is holding well inside the 0.1086–0.1352 accumulation zone, showing steady bullish structure as buyers continue defending the base. Price is tightening, signalling compression before a potential breakout. A clean move above the immediate resistance could trigger momentum toward higher levels, while the 0.0983 zone acts as the key invalidation for this setup. #req #update

12

4

3

892

Bitcoin's average daily transaction fees fall back to Ethereum levels after Runes hype subsides Average daily Bitcoin transaction fees have fallen back to the same level as Ethereum after the frenzy of activity surrounding the launch of the Runes protocol died down after the halving. The seven-day moving average of daily Bitcoin transaction fees surged to an all-time high of $25.8 million on April 24, more than five times the daily transaction fees Ethereum was generating at the time.

9

7

3

912

Crypto.com Achieves Important Regulatory Win To Expand Services In Spain Singapore-based cryptocurrency exchange Crypto.com announced that it had obtained the Bank of Spain’s Virtual Asset Service Provider (VASP) registration. The registration came after a thorough examination of the exchange’s compliance with the Anti-Money Laundering Directive (AMLD) and other financial crime legislation, as well as its user protection measures.

10

5

4

949

Bitcoin-based BRC-20 tokens combined market value eclipses $900 million Tokens created on Bitcoin through the Ordinals protocol have exceeded a total market value of $900 million, highlighting the rapid rise of an emerging asset niche on the most valuable blockchain. Ordi memecoin lead the BRC-20 category with a fully diluted value exceeding half a billion dollars, based on data from websites brc-20.io and Ordspace.

13

4

2

960

Coinbase’s chief legal officer questions SEC’s Wells process in legal dispute Coinbase's chief legal officer Paul Grewal criticized the U.S. Securities and Exchange Commission for deviating from its own Wells notice process, according to his X post on Tuesday.

13

4

2

1K

1

𝗞𝗦𝗠/𝗨𝗦𝗗𝗧 𝗠𝗔𝗥𝗞𝗘𝗧 𝗔𝗡𝗔𝗟𝗬𝗦𝗜𝗦 🚀 #KSM is stabilizing above the 25.8–29.4 support range, showing early signs of bullish pressure as buyers defend the lower zone. Structure is forming higher lows, indicating a potential shift in momentum. If KSM reclaims nearby resistance, a continuation toward mid-range targets becomes likely while price holds above the 24 support. #ksm #update

14

4

2

1.1K

1

𝗕𝗔𝗧/𝗨𝗦𝗗𝗧 𝗠𝗔𝗥𝗞𝗘𝗧 𝗨𝗣𝗗𝗔𝗧𝗘 🟢 #BAT is consolidating within an ascending channel, currently testing the 0.22 – 0.23 resistance zone. Price action shows early bullish momentum, and a clean breakout could accelerate the upward trend toward 0.26 – 0.30. Failure to breach this resistance may trigger a pullback toward 0.20 – 0.19, but the overall bullish structure remains intact, suggesting medium-term potential for continuation if support holds. #BAT #CRYPTO

13

9

6

1.1K

Ethereum Name Service proposes migration to Layer 2 ENS Labs has proposed ENSv2, a comprehensive upgrade to the Ethereum Name Service that involves migrating the service to a Layer 2 network. ENSv2 aims to enhance scalability and decrease gas fees by transferring core functionalities from the Ethereum mainnet to a Layer 2 chain, according to ENS Labs.

9

7

4

1.3K

1

RSR Showing Upward Potential 🚀 #RSR sentiment is slightly bullish with moving averages trending up. Stochastic RSI signals possible momentum, but neutral RSI and weak MACD suggest caution for now. #CryptoAnalysis #AltcoinUpdate

11

5

3

1.3K

1

𝗧𝗥𝗫/𝗨𝗦𝗗𝗧 𝗠𝗔𝗥𝗞𝗘𝗧 𝗔𝗡𝗔𝗟𝗬𝗦𝗜𝗦 🚀 #TRX has broken above a key resistance zone and is maintaining bullish momentum, showing steady higher lows and a clean structure. Buyers are controlling the move, keeping price above the breakout level. If this momentum holds, TRX could continue pushing toward higher liquidity levels, with upside potential extending into the mid-0.25–0.30 range. #trx #update

12

5

3

1.4K

2

Kraken explores pre-IPO funding round: Bloomberg Kraken is considering doing another funding round as it potentially eyes an initial public offering, Bloomberg reported Thursday, citing people familiar with the matter. The crypto exchange could raise north of $100 million in a pre-IPO round, as investors turn toward the crypto market amid a rally in token prices, sources told Bloomberg.

10

7

3

1.4K

1

𝗧𝗜𝗔/𝗨𝗦𝗗𝗧 𝗠𝗔𝗥𝗞𝗘𝗧 𝗔𝗡𝗔𝗟𝗬𝗦𝗜𝗦 🚀 #TIA is showing strong bullish momentum after holding the 2.24–2.38 accumulation range, with buyers stepping in aggressively across major exchanges. Structure favors a continuation toward upper resistance zones. If price maintains support, TIA could expand toward the 2.46–2.79 region, with further upside potential as liquidity builds above the 3+ levels. #tia #update

10

7

3

1.4K

1

𝗜𝗢𝗦𝗧/𝗨𝗦𝗗𝗧 𝗠𝗔𝗥𝗞𝗘𝗧 𝗔𝗡𝗔𝗟𝗬𝗦𝗜𝗦 🚀 #IOST is holding above the key support range and showing early signs of a bullish reversal, with buyers stepping in near the lower accumulation zone. Structure is tightening, indicating a possible breakout push. If momentum continues, price could extend toward the next resistance levels, with upside potential increasing as long as it stays above support. #iost #update

13

5

2

1.5K

1

ZEC Triangle Formation 🔺 #ZEC/USDT is consolidating within an ascending triangle, gaining momentum from the support trendline. The Ichimoku Cloud lies beneath the price, reinforcing the bullish setup. A breakout above resistance could confirm upward continuation, while a breakdown may lead to bearish movement. Watch for volume confirmation as the breakout direction will dictate the next major move.

12

5

3

1.5K

2

𝗢𝗫𝗧/𝗨𝗦𝗗𝗧 𝗠𝗔𝗥𝗞𝗘𝗧 𝗔𝗡𝗔𝗟𝗬𝗦𝗜𝗦 🚀 #OXT is showing bullish momentum after defending the support range, with price rebounding from the lower zone and forming a steady upward structure. Buyers are gradually regaining control as the chart prints higher lows. A breakout above immediate resistance could open the way toward mid-range liquidity levels, strengthening the continuation setup while support holds. #oxt #update

10

6

4

1.5K

2

📊 #LAYER Trend Reversal Setup #LAYERUSDT dropped after breaking the green trendline but now approaches key support. If the red trendline breaks, a major upward move could begin. Watch for breakout confirmation.

10

6

4

1.6K

1

QNT Bullish Reversal Confirmed 🔄 #QNTUSDT has broken its bearish pattern, signaling the start of a potential long-term upward movement. This analysis is based on the weekly time frame, so price action may take several weeks to reach its projected highs. The breakout indicates a shift in momentum with bulls gaining control.

10

6

4

1.6K

𝗙𝗔𝗥𝗧𝗖𝗢𝗜𝗡/𝗨𝗦𝗗𝗧 𝗠𝗔𝗥𝗞𝗘𝗧 𝗔𝗡𝗔𝗟𝗔𝗬𝗦𝗜𝗦 🚀 #FARTCOIN is showing early bullish momentum, with buyers stepping in from the lower range and forming the base for a potential swing move. If momentum continues, price could climb toward the 1.20–1.34 region, with extended upside possible while it holds above 0.92. #fartcoin #update

10

6

4

1.6K

1

#BSW/USDT Market Analysis 📈🚀 - #BSW shows potential for a bullish move, with support at $0.01544 and resistance at $0.0165. Price action suggests a swing trade setup, with targets at $0.0170, $0.0180, and potentially $0.024. - Momentum indicators support further upside movement. Bullish sentiment remains as long as price holds above $0.01544.

12

5

3

1.7K

1

𝗧𝗛𝗘/𝗨𝗦𝗗𝗧 𝗠𝗔𝗥𝗞𝗘𝗧 𝗔𝗡𝗔𝗟𝗬𝗦𝗜𝗦 📉📈 #THE is consolidating inside a descending channel, with the 21MA acting as a strong barrier and rejecting every attempt to move higher. Momentum remains weak as price trades just under the trendline resistance. A clean breakout above the 21MA and channel top would shift momentum bullish, opening room for a sharp move upward. Until that happens, THE stays in consolidation. #the #update

10

6

4

1.8K

1

ADA/USDT Market Analysis 🚀 - Chart Structure - #ADA is consolidating inside a symmetrical triangle, with price squeezed between descending resistance and rising support. - Market Outlook - A breakout above 0.84 could fuel upside toward 0.90–1.00, while rejection risks another retest of lower support.

12

7

5

1.9K

#XLM/USDT Market Analysis 📉 - #XLM is breaking down from a rising wedge, a bearish reversal pattern. Immediate #Resistance lies near $0.4549, while #Support stretches down to $0.38. - Price action suggests downward pressure with lower highs forming. Sentiment stays bearish unless price reclaims the wedge support level.

10

6

5

2K

1

OBOL/USDT Market Analysis 🚀 - Technical: #OBOL has formed a bullish setup with the bottom confirmed and a second wave starting. Entry zone: current levels. Take-Profit levels: 0.113 and 0.115. Stoploss: 0.095. Leverage: 5–10x. - Trade: The chart suggests upside continuation, keeping the bias long. As long as price stays above 0.095, buyers remain in control. A break of 0.095 cancels the setup and shifts momentum.

12

7

5

2K

#COS/USDT Market Analysis 🚀📈 - #Cos has confirmed a high-volume breakout after a complete bottoming formation, signaling renewed bullish momentum. Strong #Support now forms at the breakout zone. - Price action suggests a bullish continuation, with short liquidations likely fueling the move. Sentiment remains firmly bullish as long as volume sustains and structure holds.

12

6

4

2.1K

1

GRT Triangle Breakout Watch 🚀 - #GRTUSDT consolidates in a descending triangle on 4H. Support holds at $0.084–$0.088, resistance at $0.093–$0.100. - Breakout above $0.100 targets $0.104–$0.112. Losing $0.084 risks drop to $0.075–$0.072. #TheGraph #CryptoSignals

10

9

6

2.1K

MBOX/USDT Market Analysis 🚀 - Technical Setup - #MBOX has formed a bullish setup, showing upside momentum. The entry zone is 0.062 – 0.0590. Take-Profit levels are 0.063 and 0.064, with Stoploss at 0.0541. Leverage range: 3–5x. - Market Outlook - The chart confirms upside potential, keeping the bias Long. As long as price stays above 0.0541, buyers remain in control. A break of 0.0541 cancels the bullish setup and shifts momentum.

14

6

5

2.2K

#RUNE Bullish Cycle Loading 🔁 - #RUNEUSDT is trading at bottom prices, mirroring past sideways accumulation phases seen in Oct 2023 and late 2020. Each time, it led to a major bullish wave. - Current structure signals a potential 6–12 month uptrend. If history repeats, strong upside could follow soon. #Thorchain #CryptoAnalysis

10

6

5

2.2K

1

𝗦𝗘𝗜/𝗨𝗦𝗗𝗧 𝗠𝗔𝗥𝗞𝗘𝗧 𝗔𝗡𝗔𝗟𝗔𝗬𝗦𝗜𝗦 🚀 #SEI is forming a high-risk bullish setup, holding above the 0.228 zone as buyers attempt to regain control after the recent pullback. Structure suggests early signs of a potential upward shift. If momentum holds, SEI could push toward the 0.242–0.265 region, with extended upside possible while price remains above 0.2125. #sei #update

10

6

4

2.2K

1

#ETH Bullish Ascending Channel 🚀 - #ETH is growing within an ascending channel, aiming for a new ATH, similar to Bitcoin's recent breakout. - With the market in full bullish momentum, we expect altcoins to follow suit and rise consecutively. #Ethereum #CryptoGrowth

11

6

4

2.3K

1

#MBOX/USDT Market Analysis 📈 - #MBOX has emerged from a consolidation pattern, hinting at a bullish outlook. Support at $0.0541, with resistance at $0.063. - Price action may indicate a continuation upward, potentially reaching higher levels. Bullish sentiment holds above $0.0541.

10

7

4

2.5K

BAS/USDT Market Analysis 🚀 - Technical: #BAS has formed a bullish setup with the bottom confirmed, signaling upside momentum. Entry zone: current levels. Take-Profit targets not specified. Stoploss: 0.0168. Leverage: 5–10x. - Trade: The chart suggests upside continuation, keeping the bias long. As long as price stays above 0.0168, buyers remain in control. A break of 0.0168 cancels the setup and shifts momentum.

11

8

7

2.6K

#STG Uptrend Potential 🚀 - #STGUSDT has bounced from the support trendline after a long decline, hinting at the start of an upward trend. Undervalued among altcoins, it could see multiple growth if the market rallies. - Key resistance is $0.1886 — a breakout here could confirm the bullish move. #Stargate #CryptoSignals

10

8

4

2.8K

𝗦𝗜𝗥𝗘𝗡/𝗨𝗦𝗗𝗧 𝗨𝗣𝗗𝗔𝗧𝗘 🟢 #SIREN is showing bullish continuation from the accumulation zone, with strong demand holding near 0.0696 – 0.0714, suggesting potential for upward expansion. Price action indicates strength with targets between 0.0743 – 0.1000 in the short term, while 0.0649 acts as a key support for risk management. #SIREN #CRYPTO

15

11

5

3.1K

3

𝗦𝗢𝗟/𝗨𝗦𝗗𝗧 𝗨𝗣𝗗𝗔𝗧𝗘 🔴 #SOL is facing strong resistance in the 152.90–162.70 zone, with price reacting within the descending channel, indicating short-term selling pressure. A rejection here favors lower channel support, while a daily close above could signal potential trend reversal and renewed bullish momentum. #SOL #CRYPTO

11

9

5

4.1K

1

ETH/USDT Market Analysis 🚀 - Chart: #ETH is trading inside a broad ascending channel, testing the key resistance zone at $4,880–$5,000, aligned with the channel top. - Market: A breakout above could fuel continuation toward $5,500–$6,000. Rejection may send price back to $3,500–$3,000 support, though the long-term structure stays bullish above major supports.

12

9

6

4.2K

#XRP/USDT Market Analysis 📈🔥 - #Xrp has broken out of a Bull Flag pattern, signaling bullish continuation potential. Key #Support lies between $3.2200 – $3.2770, with initial #Resistance at $3.36. - Momentum favors further upside if buyers sustain control. Sentiment remains bullish while price holds above $3.16 #Support.

10

8

5

4.5K

ETH/USDT Market Analysis 🚀 - Chart: #ETH has broken below its ascending trendline after rejection near $4,300, signaling short-term weakness as sellers regain control. - Market: Price is consolidating near $4,000 support. Holding above could spark recovery toward $4,250–$4,300, while failure risks a drop to $3,860–$3,640. #bearish #retest

12

8

6

4.6K

1

LDO Breakout Watch 📈 - #LDO is near downtrend ceiling in critical decision zone. Break could signal bullish reversal - Prepare for long position after pullback and confirmation. Targets visible on chart if break occurs #Lido #CryptoTrading

11

10

6

4.7K

𝗡𝗘𝗢/𝗨𝗦𝗗𝗧 𝗠𝗔𝗥𝗞𝗘𝗧 𝗔𝗡𝗔𝗟𝗬𝗦𝗜𝗦 🚀 𝗖𝗵𝗮𝗿𝘁: #NEO is showing early bullish momentum with potential for an uptrend start as price tests the upper boundary of the descending channel. 𝗠𝗮𝗿𝗸𝗲𝘁: A breakout above the channel would confirm reversal, allowing price to aim for the identified target zones on the chart. #bullish #setup

11

8

3

4.8K

𝗕𝗔𝗡𝗗/𝗨𝗦𝗗𝗧 𝗠𝗔𝗥𝗞𝗘𝗧 𝗔𝗡𝗔𝗟𝗔𝗬𝗦𝗜𝗦 🚀 #BAND is forming a strong reversal structure off the support zone, with buyers stepping in aggressively and building early bullish momentum. Price action shows strengthening demand at the base. If this trend holds, BAND could rise toward the 0.535–0.780 region, with further upside potential while price remains above 0.4500. #band #update

11

8

3

4.8K

1

𝗖𝗨𝗗𝗜𝗦/𝗨𝗦𝗗𝗧 𝗠𝗔𝗥𝗞𝗘𝗧 𝗔𝗡𝗔𝗟𝗔𝗬𝗦𝗜𝗦 🚀 #CUDIS has delivered a clean breakout with strong volume, signalling the start of a bullish expansion phase as buyers dominate the structure. Momentum remains firmly in favour of the uptrend. If strength continues, CUDIS could push toward the 0.060–0.094 region, with extended upside potential while price stays above the key 0.0457 support. #cudis #update

11

8

5

4.9K

𝗔𝗩𝗔/𝗨𝗦𝗗𝗧 𝗠𝗔𝗥𝗞𝗘𝗧 𝗔𝗡𝗔𝗟𝗬𝗦𝗜𝗦 🚀 #AVA is showing strong bottom accumulation, with price forming a clean reversal base after an extended downtrend. Buyers are stepping in aggressively, signalling early momentum for a larger structural shift. If strength continues, AVA could start expanding toward the 0.40–0.54 region, with broader upside potential as long as price holds above the key 0.295 support zone. #ava #update

11

8

4

5.1K

SOL/USDT Market Analysis 🚀 - Chart: #SOL is trading close to a downtrend line, with price expected to test the $191–$194 resistance range soon. - Market: This zone could act as a supply area, where rejection may lead to a pullback or continuation of the downtrend. #bearish #setup

11

9

4

5.1K

1

𝗕𝗗𝗫𝗡/𝗨𝗦𝗗𝗧 𝗨𝗣𝗗𝗔𝗧𝗘 🟢 #BDXN is showing a fully bottomed bullish reversal, forming a strong setup with potential for a 10x move on Binance Futures. Early momentum suggests buyers are stepping in at the 0.025 level. Price strength points to short-term upside toward 0.027 – 0.043, while 0.0198 serves as key support for risk management. #BDXN #CRYPTO

11

7

3

5.5K

𝗘𝗧𝗛/𝗨𝗦𝗗𝗧 𝗠𝗔𝗥𝗞𝗘𝗧 𝗔𝗡𝗔𝗟𝗬𝗦𝗜𝗦 🚀 𝗖𝗵𝗮𝗿𝘁: #ETH has broken its downward trendline on the 4-hour chart, signaling a potential shift toward bullish momentum. 𝗠𝗮𝗿𝗸𝗲𝘁: A pullback to the broken trendline could provide support before continuation of the upward trend resumes. #bullish #reversal

11

8

3

5.7K

3

𝗕𝗥𝗘𝗧𝗧/𝗨𝗦𝗗𝗧 𝗠𝗔𝗥𝗞𝗘𝗧 𝗔𝗡𝗔𝗟𝗔𝗬𝗦𝗜𝗦 🚀 #BRETT continues to show strong accumulation at the support zone, with rising volume confirming steady buyer interest and a tightening bullish structure forming at the base. If momentum builds, price could expand toward the 0.035–0.045 region, with broader upside potential as long as it holds above the key support at 0.02655. #brett #update

10

8

4

6K

𝗦𝗡𝗫/𝗨𝗦𝗗𝗧 𝗠𝗔𝗥𝗞𝗘𝗧 𝗔𝗡𝗔𝗟𝗔𝗬𝗦𝗜𝗦 🚀 #SNX has formed a clean uptrend opportunity on the 4H timeframe, with price reacting strongly from support and showing early bullish momentum. A confirmation candle is needed before entering. If confirmed, price could move upward and reach the targets marked on the chart, aligning with the current continuation structure. #snx #update

15

11

6

6.7K

𝗖𝗛𝗘𝗦𝗦/𝗨𝗦𝗗𝗧 𝗠𝗔𝗥𝗞𝗘𝗧 𝗔𝗡𝗔𝗟𝗔𝗬𝗦𝗜𝗦 🚀 #CHESS is showing bullish reversal signs near the bottom zone, with buyers stepping in and forming early strength after defending key support levels. If momentum builds, CHESS could push toward the 0.071–0.079 region, with extended upside potential while structure holds above 0.05884. #chess #update

14

8

6

6.8K

1

𝗕𝗧𝗖/𝗨𝗦𝗗𝗧 𝗠𝗔𝗥𝗞𝗘𝗧 𝗨𝗣𝗗𝗔𝗧𝗘 🚀 𝗖𝗵𝗮𝗿𝘁: #BTC pulled back to the trendline after the break and then started a downtrend. The EMA200 acted as strong resistance, but price eventually broke below it. 𝗠𝗮𝗿𝗸𝗲𝘁: This breakdown signals the start of a bigger downtrend, with bearish momentum now taking control. #bearish #update

11

8

4

6.9K

1

BNB/USDT Market Analysis 🚀 - Chart: #BNB has broken above long-term resistance, turning the $780–$800 zone into strong support. - Market: Holding this area keeps the path open toward $1,100–$1,200. A breakdown below $780 could trigger a deeper correction instead.

19

9

7

7.1K

ETC/USDT Market Analysis 🚀 - Chart: #ETC is trading inside an ascending channel, showing steady structure while other altcoins have already rallied. - Market: A breakout above the upper trendline could trigger a strong upward move, targeting at least the channel ceiling for potential growth.

12

11

10

7.2K

1

𝗔𝗗𝗔/𝗨𝗦𝗗 𝗨𝗣𝗗𝗔𝗧𝗘 🟢 #ADA reached a major demand zone at $0.40–$0.38, showing strong historical reactions. Holding above this support favors a relief bounce toward $0.55–$0.60. Continued bullish momentum could extend price toward the supply area near $0.82–$0.85 if buyers remain strong and market conditions support upward moves. #ADA #CRYPTO

9

8

6

7.3K

𝗔𝗦𝗧𝗘𝗥/𝗨𝗦𝗗𝗧 𝗠𝗔𝗥𝗞𝗘𝗧 𝗔𝗡𝗔𝗟𝗬𝗦𝗜𝗦 🚀 #ASTER is breaking out of a long consolidation zone with strong support from the rising trendline. Holding above the reclaimed horizontal resistance keeps momentum tilted to the upside. A clean retest followed by higher lows could drive price toward $1.60–$1.90. Bulls remain in control while structure stays intact. #aster #update

13

11

8

8K

1

𝗧𝗢𝗦𝗛𝗜/𝗨𝗦𝗗𝗧 𝗠𝗔𝗥𝗞𝗘𝗧 𝗔𝗡𝗔𝗟𝗔𝗬𝗦𝗜𝗦 🚀 #TOSHI is showing renewed bullish pressure within its accumulation zone, with buyers defending the lower range and forming a steady base for the next upward impulse. If momentum continues, TOSHI could climb toward the 0.00098–0.00190 region, with further upside potential as long as price holds above 0.0008392. #toshi #update

13

10

5

8.8K

2

𝗟𝗧𝗖/𝗨𝗦𝗗𝗧 𝗠𝗔𝗥𝗞𝗘𝗧 𝗔𝗡𝗔𝗟𝗔𝗬𝗦𝗜𝗦 🚀 #LTC is showing bullish momentum after defending key support, with buyers maintaining control and forming a steady upward structure as price attempts to break into higher ranges. If this strength continues, LTC could move toward the 107.5–112 region, with extended upside potential while price remains above 100. #ltc #update

13

10

10

9.5K

1

Listing Statistics

260

2 months ago

SeBuDA

Recently our headquarters moved from USA to Netherland so we could make more features for our users, we sure that our users can feel the changes in the future and this decision is for sake of our users

Netherland

Sebuda B.V.

CoC Number: 95490469

Zuid-Hollandlaan 7, 2596AL ‘s-Gravenhage

The Hauge, The Netherlands

(+31)0687365374

Be with us on Social Networks

Social media accounts for sale

Help and Services

© 2022 SeBuDA.com, All rights reserved.