Share to ...

Copy Link

Coen Bradley******rypto | 9.9K followers telegram account

1 months aged

@******rypto

Followers

9.9K

Posts

39

Price(USD)

$140

Category

Crypto

Date of Joined

Jan 2026

Date of Last Post

Jan 16, 2026

Last 36 posts

texts

5

Pictures

32

Videos

0

audios

0

documents

0

animations

0

Last 36 posts

Averages

Views

1.1K

Post/Per Month

0

Post/Per Month

Besties

JUST IN: CryptoPunk #1021 was sold for 720 ETH, equivalent to $2.58 million.

1.4K

Top 10 Hashtags

No Data

Description

🔥 Premium Telegram channel Category : Crypto & Trading & Forex ─ The channel has many promoted posts that can be changed to suit your needs. _ The channel has stable high quality followers. ✔️ Channel never violated any rules, no restrictions or bans on it. ✅ It's your ideal choice to start or promote your business. ✔️ Full transfer of the channel to your TG account, you will be the sole abd full owner. ⚡ Instant Delivery ⚡

Last Posts

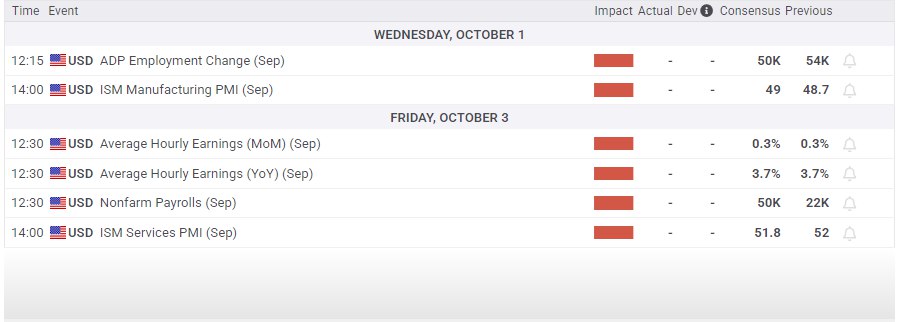

EUR/USD Price Forecast: Near-term price action looks at US NFP data EUR/USD’s downside momentum is gathering pace, opening the door to a deeper near-term pullback as markets position ahead of December’s all-important US Nonfarm Payrolls... Read More👈

270

WTI Oil falls to one-month lows amid Ukraine peace talks, supply concerns West Texas Intermediate (WTI) US Oil trades around $57.60 on Friday at the time of writing, down 1.90% on the... Read More👈

636

Dow Jones Industrial Average hesitates as government shutdown looms The Dow Jones Industrial Average (DJIA) hit a fresh patch of bearishness on Monday, easing back slightly from the week’s early highs near... Read More👈

649

Nasdaq futures hold key structure as price compresses toward major resistance zones Daily projections and intraday micro-structure converge as futures compress inside key... Read More👈

656

EUR/USD ranges near 1.1750 as soft US jobs solidify Fed easing bias EUR/USD holds firm at around 1.1750, virtually flat after the latest US jobs report reinforced the chances that the Federal Reserve (Fed) could continue its easing cycle into next year. At the time of writing, the pair posted minuscule losses of... Read More👈

945

AUD/USD kicks off key week with another bullish foot forward AUD/USD rose on Monday, testing around one-fifth of one percent higher to kick off the new trading... Read More👈

960

The weekender: September’s cliff, AI turns to ballast, China liquidity burns hot, and Gold stands tall The tape closed August with a reminder that gravity still works, even on the... Read More👈

965

Gold rises on dovish Fed bets and soft US economic indicators Gold (XAUUSD) is gaining momentum as markets anticipate a Federal Reserve rate cut in December. Investors are positioning for the return of key economic data as the government edges closer to reopening. Soft labour figures and weak consumer data have increased expectations for policy... Read More👈

981

German fiscal stimulus package key to EUR leg up against USD The euro edged back up towards the 1.16 level on the US dollar towards the end of last week, although it was a week devoid of any real major domestic news, aside from some slightly disappointing September retail sales... Read More👈

1K

Gold plunges below $4,100 as hawkish Fed rhetoric trims December rate-cut bets Gold (XAU/USD) tumbles near 2% on Friday yet it has recovered after reaching a daily low of $4,032 on growing speculation that the Federal Reserve might pause its easing cycle as most officials struck a hawkish... Read More👈

1K

AUD/USD Price Forecast: Hovers around 0.6700, nine-day EMA The AUD/USD pair is recovering its recent losses registered in the previous session, trading around 0.6700 during the European hours on Wednesday. The daily chart’s technical analysis indicated a weakening bullish bias as the pair is positioned slightly below the ascending channel... Read More👈

1K

🗓 Week ahead – US CPI might challenge the geopolitics-boosted Dollar Geopolitics may try to steal the limelight from US data. A possible US Supreme Court ruling on tariffs could dictate market movements. A crammed data calendar next week, US CPI comes on Tuesday; Fedspeak to intensify. ✍ Stay tuned!

1K

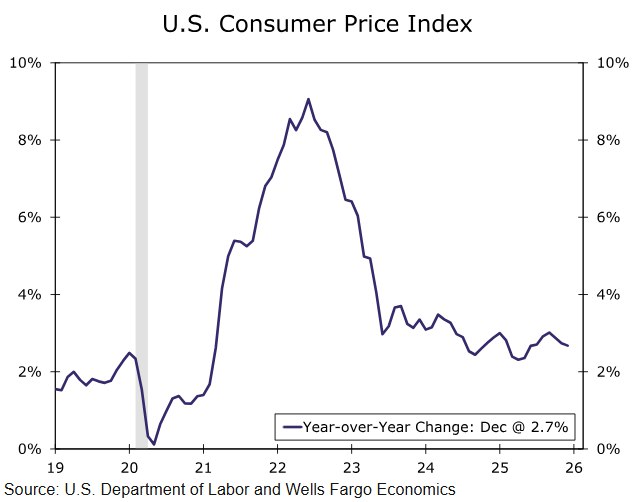

December CPI: No coal in the stocking The CPI report covering the final month of 2025 generally was encouraging. Core CPI in December rose 12 bps less than our forecast, largely on the back of a smaller-than-expected bounce back in core goods inflation after November's unusually soft, shutdown-delayed... Read More👈

1K

🚀 Potential Q3 token launches to watch Here’s a curated list of likely Q3 launches, mostly DeFi and infra-focused: ➡️ MeteoraAG — Advanced Solana DEX ➡️ Infinit Labs — DeFi AI agents platform ➡️ OpenEden X — RWA stablecoin issuer ➡️ LineaBuild — Consensys’s Ethereum L2 ➡️ Folks Finance — Crosschain lending ➡️ PlasmaFDN — L1 for stablecoins ➡️ PortaloBitcoin — Native BTC swap ➡️ FalconStable — fast-growing stablecoin issuer ➡️ Reservoir — multi-asset stablecoin ➡️ WLFI — Trump’s DeFi project ➡️ MegaETH — scalable L2 (Sept mainnet) ➡️ Solana Mobile — Solana smartphone token (SKR) ➡️ Avantisfi — perp DEX on Base The real rotation often starts where no one’s looking

1.1K

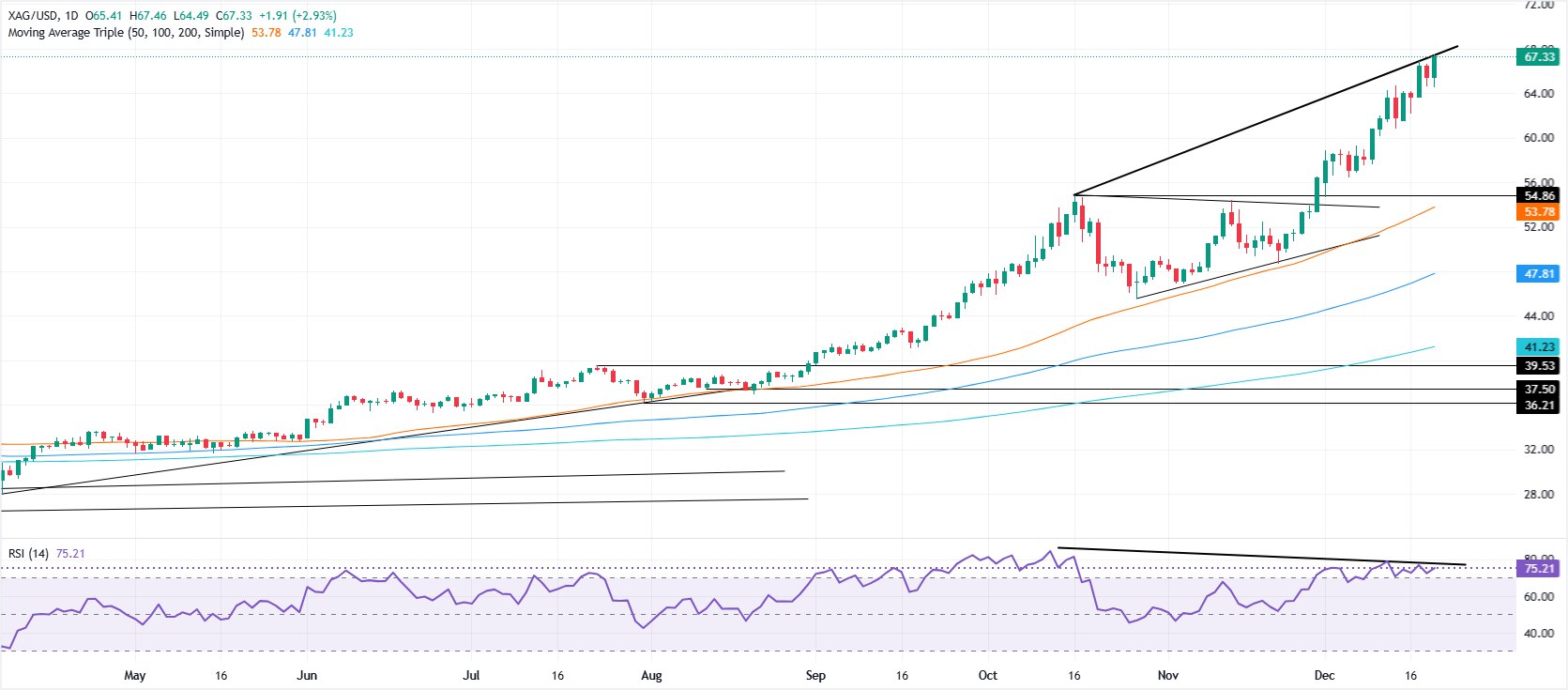

Silver Price Analysis: XAG/ÜSD surges to new all-time highs near $67.50 Silver price rallies to a new all-time high of $67.45 even though US Treasury yields and the Dollar remained firm on Friday, amid the lack of catalysts, except for the US Consumer Sentiment poll made by the University of Michigan, which showed that US households are trimming spending on durable... Read More👈

1.1K

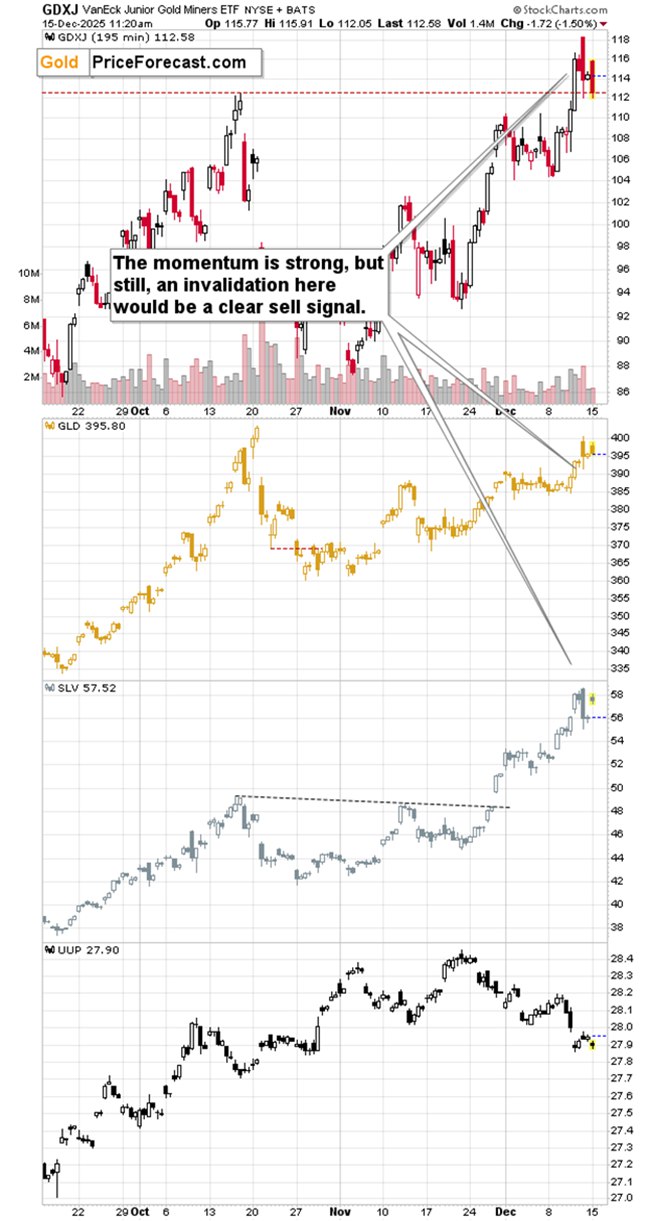

Silver soars, miners disappoint: The new normal Few people seem to have believed me when I wrote that silver was likely to disconnect from the rest of the precious metals sector due to its unique fundamental... Read More👈

1.1K

Gold surges toward $4,100 as markets go all-in on Fed cuts Gold (XAU/USD) rallies sharply on Monday, gaining 0.80% as investors seem confident that the Federal Reserve (Fed) will slash rates at the December meeting as US economic data continues to flow. At the time of writing, XAU/USD trades near $4,100 after hitting a daily low of... Read More👈

1.1K

WTI Oil outlook: WTI oil resumes larger downtrend WTI oil remains firmly in red and fell to nine-week low on Wednesday, signaling continuation of larger downtrend which paused for a brief consolidation in past three... Read More👈

1.1K

USD/CAD Price Forecast: Eyes fresh six-month highs near 1.4150 within overbought zone USD/CAD continues its winning streak for the seventh consecutive day, trading around 1.4120 during the European hours on Friday. The technical analysis of the daily chart indicates a prevailing bullish bias, with the pair remaining within the ascending channel... Read More👈

1.1K

Silver’s strategic turn: Why the market can no longer treat it as a simple precious metal 💥 Silver is no longer just a monetary hedge. It is becoming one of the most strategically important materials in the global economy. The recent move above 54,00 $, followed by a controlled pullback toward 52,60 $, is not simply a technical fluctuation. What's next for XAG/USD?

1.2K

USD/CAD Price Forecast: Hovers around 1.4050 near nine-day EMA support USD/CAD remains stable after registering modest gains in the previous session, trading around 1.4050 during the European hours on Tuesday. The daily chart’s technical setup reflects a persisting bullish bias, with the pair continuing to trade within its ascending... Read More👈

1.2K

📄 Weekly DeFi Recap ➡️ Pendle released Boros on Arbitrum — trade funding rates ➡️ Jupiter Lend (by Fluid) went live in private beta on Solana ➡️ Silo Finance added one-click auto-leverage for high yields ➡️ INFINIT launched $IN and opened airdrop claim portal ➡️ GammaSwap introduced Yield Tokens — AMM yield, no IL ➡️ DeFi App rolled out mobile beta version ➡️ Sonic and Meteora launched updated airdrop checkers ➡️ Fluid deployed DEX Lite to mainnet — aiming for $200M–$400M daily volume ➡️ Falcon Finance launched Kaito yapper leaderboard ➡️ Ventuals announced pre-IPO startup trading via Hyperliquid ➡️ Linea partnered with Lido to stake all bridged ETH ➡️ CoW DAO enabled cross-chain swaps with Bungee ➡️ GTE Exchange exited MegaETH ecosystem ➡️ Mantle onboarded two senior execs from Bybit as advisors ➡️ SEC stated liquid staking tokens are not securities ➡️ White House drafting fines for banks blocking crypto firms DeFi keeps shipping — one feature, one fight at a time.

1.2K

XAU/USD outlook: Gold hits new multi-week high on Fed rate cut expectations/weaker Dollar Gold continues to trend higher and hit the highest in six weeks on Monday, supported by growing expectations for Fed rate cut in... Read More👈

1.2K

Silver’s back up, miners are not: The disconnect is real Exactly. The dynamic is different than it used to... Read More👈

1.2K

Dow Jones Industrial Average drops as markets await Fed The Dow Jones Industrial Average (DJIA) shed 275 points at its lowest on Tuesday as investors buckle down ahead of the latest interest rate decision from the Federal Reserve... Read More👈

1.2K

Gold firms in muted trading amid rising conviction of Fed cut Gold (XAU/USD) remains firm during the North American session on Thursday amid a low-volume trading session as US markets remain closed in observance of the Thanksgiving holidays. At the time of writing, XAU/USD trades at $4,158, virtually... Read More👈

1.2K

Dow Jones Industrial Average climbs 450 points after early AI shudders The Dow Jones Industrial Average (DJIA) rose 450 points on Wednesday, sparked by renewed market optimism that the US economy is performing so poorly that the Federal Reserve (Fed) will be forced to deliver a third straight interest rate cut in... Read More👈

1.2K

Gold prices eye a rebound after Monday’s $240 wipeout Gold steadied Tuesday after Monday’s pullback, with New York futures up 1% at $4,380 a troy ounce and still hovering near record... Read More👈

1.2K

🤖 AI boom or bubble? Three convictions for investors AI 2.0 = from “build it” to “prove it”: Big Tech’s AI investment is already in the hundreds of billions, but monetization remains modest. The cycle is shifting from spending on capacity to delivering productivity and revenue impact. 🔥 Click and read!

1.2K

$102M liquidated across crypto markets in 4 hours $93M in longs, $8.3M in shorts.

1.2K

EUR/USD stable near 1.1740 with Fed officials suggesting a pause in easing EUR/USD holds firm at around 1.1741 on Friday virtually unchanged, amid a parade of Federal Reserve officials crossing the wires, following last Wednesday's 25 basis points rate... Read More👈

1.2K

🤖 Weekly focus – Fears of an AI bubble top the agenda Global stocks are heading towards their worst week since April with tech stocks under pressure. Despite Nvidia delivering yet another strong result and an upbeat revenue forecast, investor concerns regarding an AI bubble remain 🫧 Know more here!

1.2K

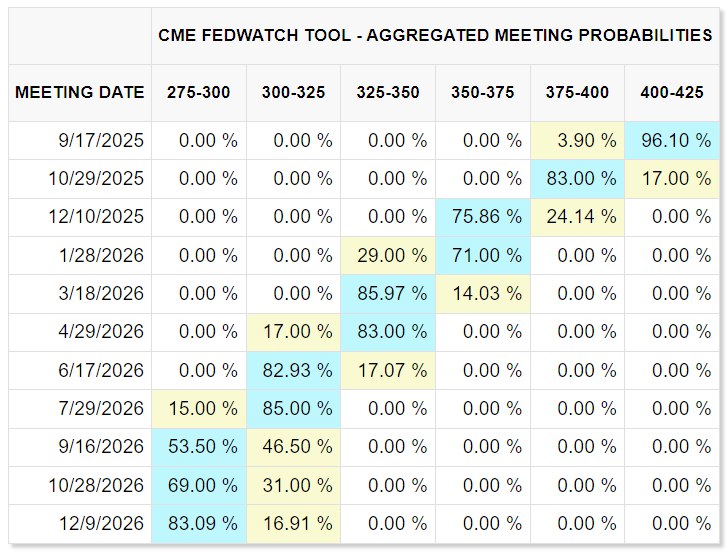

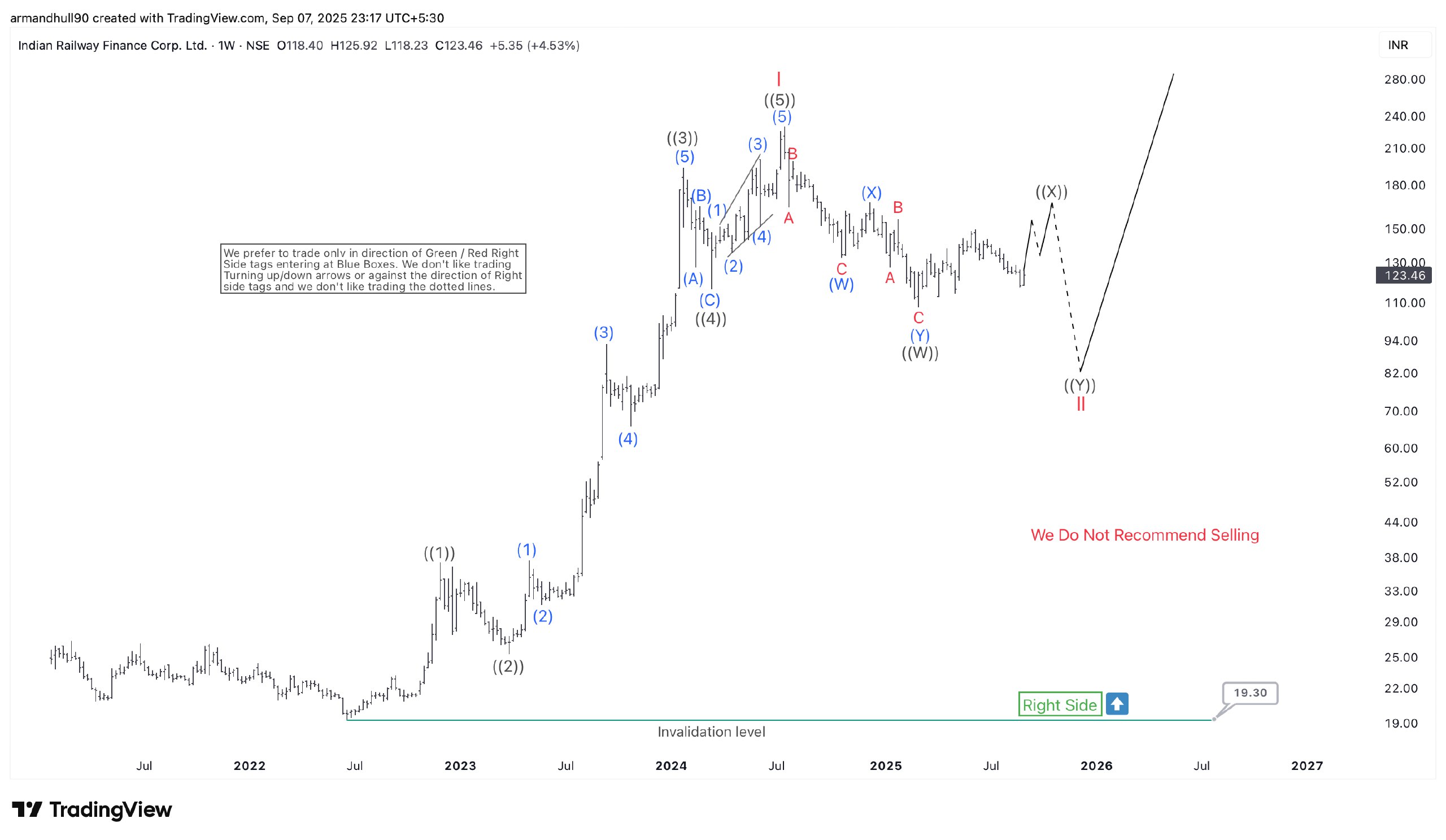

IRFC Elliott Wave analysis: Wave II correction nearing completion before major bullish rally Indian Railway Finance Corporation Ltd. (IRFC) is correcting within a double three Elliott Wave pattern in wave II after completing a strong five-wave rally in wave... Read More👈

1.2K

Gold Price Forecast: XAU/USD comfortable above $4,200 Gold prices are up on Tuesday, with the bright metal now hovering around $4,215 a troy ounce. A better market mood undermines near-term demand for the US Dollar (USD), despite the improved sentiment surging from upbeat United States (US)... Read More👈

1.2K

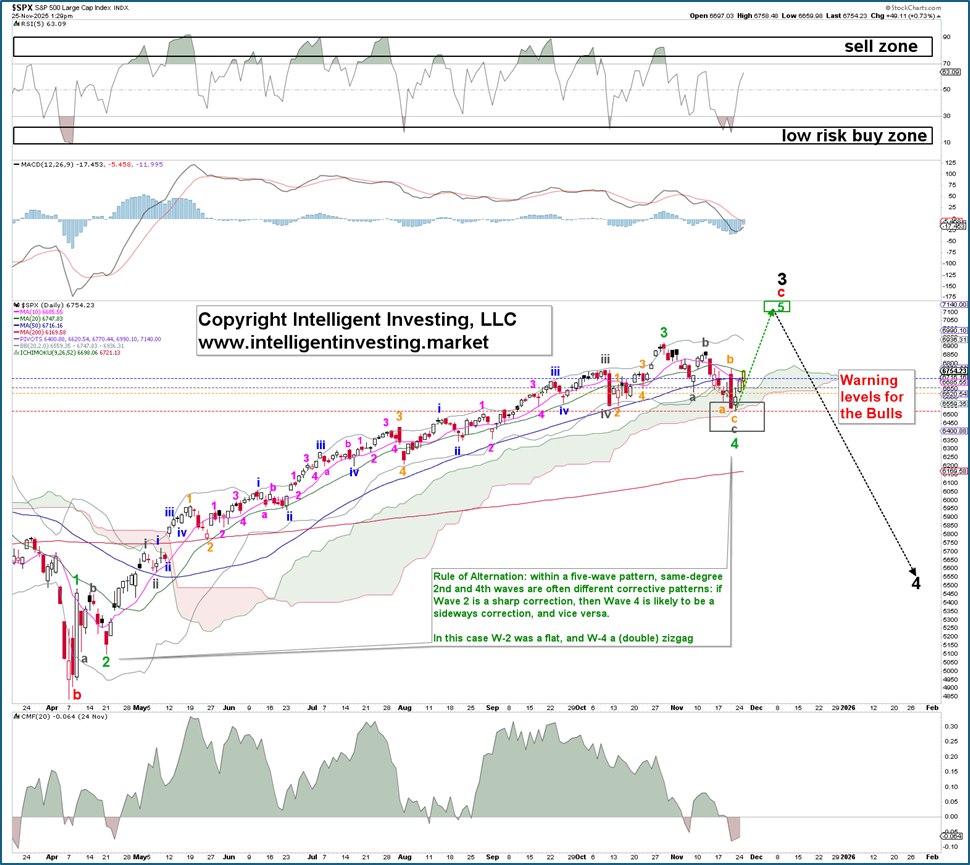

SP500 Elliott Wave update: Is the correction over? We have been monitoring the SP500 (SPX) to reach approximately 7120 in an Elliott Wave (EW) Principle impulse (five-wave) move upward from the early April lows for a more significant top for some time, and in our previous update from November 10, we were tracking a... Read More👈

1.3K

Marvell Technology earnings foreshadow a bad September ahead Marvell Technology (MRVL) had a solid quarter. But you wouldn't know that from the +16% drop in its share price on... Read More👈

1.3K

JUST IN: CryptoPunk #1021 was sold for 720 ETH, equivalent to $2.58 million.

1.4K

SeBuDA

Recently our headquarters moved from USA to Netherland so we could make more features for our users, we sure that our users can feel the changes in the future and this decision is for sake of our users

Netherland

Sebuda B.V.

CoC Number: 95490469

Zuid-Hollandlaan 7, 2596AL ‘s-Gravenhage

The Hauge, The Netherlands

(+31)0687365374

Be with us on Social Networks

Social media accounts for sale

Help and Services

© 2022 SeBuDA.com, All rights reserved.