Share to ...

Copy Link

Social Edge********Channel | 16K followers telegram account

106 months aged

@********Channel

Followers

16K

Price(USD)

$200

Category

Crypto

Date of Joined

Dec 2016

Date of Last Post

Oct 30, 2025

Last 36 posts

texts

0

Pictures

36

Videos

0

audios

0

documents

0

animations

0

Last 36 posts

Averages

Views

3.4K

Post/Per Month

0

Post/Per Month

Besties

#XAU/USD 🔴 Sell Now Entry Point: 4025 Profit Targets: 4010, 3996 Exit Point: 4031 #XAU/USD showing bearish rejection from resistance zone with momentum favoring a move toward lower support areas. ------------------------------- Trade at your own risk. Prioritize money management: assess risk, set limits, and never invest more than you can afford to lose.

10.6K

Top 10 Hashtags

Description

No Data

Last Posts

𝗘𝗨𝗥𝗨𝗦𝗗 𝗠𝗮𝗿𝗸𝗲𝘁 𝗔𝗻𝗮𝗹𝘆𝘀𝗶𝘀 ⚡️ 𝗧𝗲𝗰𝗵𝗻𝗶𝗰𝗮𝗹: On the 5-minute chart, #EURUSD has taken liquidity above previous highs and is showing bearish momentum after breaking the trendline. Sellers remain active near resistance. 𝗧𝗿𝗮𝗱𝗲: Below 1.1610–1.1620, bias stays bearish toward 1.1580–1.1560. Break above 1.1630 invalidates. #EURUSD #ForexSignals

2.3K

#EUR/AUD 🟢 Buy Limit Entry Point: 1.7693 Profit Targets: 1.7950, 1.8160 Exit Point: 1.7550 #EUR/AUD approaching key demand zone; a bullish reversal is expected if price reacts positively from this support area. ------------------------------- Trade at your own risk. Prioritize money management: assess risk, set limits, and never invest more than you can afford to lose.

3.5K

#XAUUSD Market Analysis ⚡️ - Technical: On the 15M chart, #XAUUSD is holding above the $4,095–$4,110 support zone, showing consolidation after a sharp drop. A break below this level could trigger further downside toward $4,060–$4,030, while holding above may lead to a rebound. - Trade: Watch for a clean breakout confirmation before entry. #GoldAnalysis #ForexSignals

5.7K

#USD/JPY 🟢 Buy Setup Entry Point: 150.20 – 150.00 (Fibonacci 50%–61.8% zone) Profit Targets: 151.00, 151.80, 152.20 Exit Point: 149.40 #USD/JPY showing potential buying opportunity once price completes its correction phase, with key confluence at 50% and 61.8% Fibonacci retracement levels. ------------------------------- Trade at your own risk. Prioritize money management: assess risk, set limits, and never invest more than you can afford to lose.

7.8K

#USDJPY Market Analysis ⚡️ - Technical: On the 15M chart, #USDJPY rejected the 151.30 supply zone, forming a lower high and signaling potential bearish momentum below 151.10–151.30. - Trade: Watch for a pullback toward 150.90–150.60. A rejection confirms downside continuation; break above 151.30 invalidates. #ForexSignals #USDJPY

9.6K

#XAU/USD 🔴 Sell Now Entry Point: 4025 Profit Targets: 4010, 3996 Exit Point: 4031 #XAU/USD showing bearish rejection from resistance zone with momentum favoring a move toward lower support areas. ------------------------------- Trade at your own risk. Prioritize money management: assess risk, set limits, and never invest more than you can afford to lose.

10.6K

#XAUUSD Market Analysis ⚡️ - Technical: On the 15M chart, #XAUUSD is rebounding from a demand zone around $3,840–$3,845, showing early signs of bullish continuation. The price structure suggests a possible push toward the $3,860–$3,870 resistance area if support holds. - Trade: Bias remains bullish above $3,840, targeting $3,860–$3,870. A break below $3,835 could invalidate this setup and invite short-term downside pressure.

7.5K

#GBP/JPY 🟢 Buy Setup Entry Point: 198.20 Profit Targets: 199.00, 200.00 Exit Point: 197.50 #GBP/JPY if price completes correction wave 4, a bullish wave 5 is expected to follow, providing a strong buying opportunity. ------------------------------- Trade at your own risk. Prioritize money management: assess risk, set limits, and never invest more than you can afford to lose.

5K

#US30 Market Analysis ⚡️ - Technical: On the 15M chart, #US30 is consolidating below the 46,360–46,400 supply zone. Price is testing the 46,280 support level. A confirmed break below this zone could trigger further downside momentum. - Trade: Bearish setup is valid below 46,280, targeting 46,150–46,000. A recovery above 46,360 cancels the bearish view.

3K

#EUR/USD 🟢 Buy Limit Entry Point: 1.1780 Profit Targets: 1.1820 Exit Point: 1.1760 #EUR/USD showing bullish signs with Elliott Wave correction nearing completion and strong bounce expected from fib support zone. ------------------------------- "Trade at your own risk. Prioritize money management: assess risk, set limits, and never invest more than you can afford to lose."

1.6K

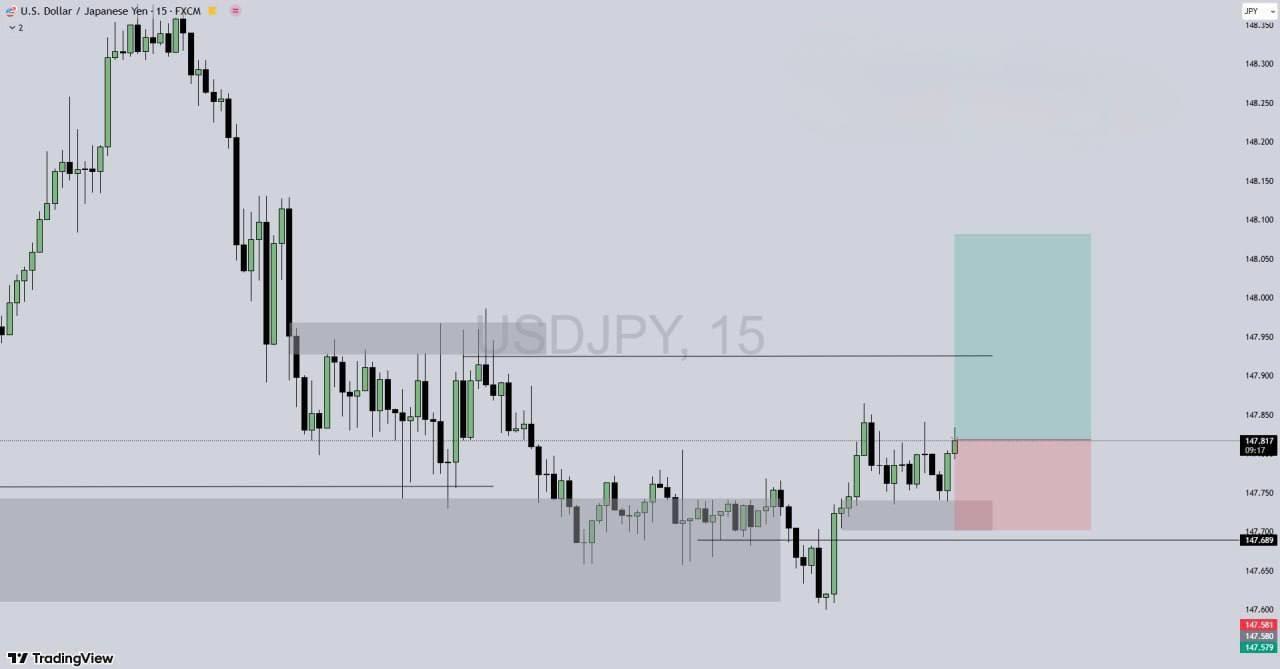

#USDJPY Quick Trade Setup ⚡️ - Technical: On the 15M chart, #USDJPY is rebounding from demand, showing strong bullish intent. Price has reclaimed 147.70 support and eyes the supply zone at 148.10–148.20. - Trade: Intraday long setup is valid above 147.68. Momentum continuation targets 148.00+, while below 147.57 the setup is invalidated.

2.1K

#AUD/CAD Market Analysis 📈 - Technical: #AUDCAD on the 4H chart is completing wave (4) and preparing for the next impulsive move higher. Price action remains above 0.9100 support, with #MACD showing early bullish crossover signals. - Trade: A continuation toward 0.9200 resistance zone is expected as wave (5) unfolds. As long as price holds above 0.9100, sentiment stays Bullish.

3.9K

#NZD/USD Market Analysis 📉 - #NZDUSD on the 4H chart is rejecting the 0.5960 resistance zone, completing a corrective wave (C) and showing weakness at key #Resistance. #MACD is signaling fading momentum. - A bearish continuation could unfold, targeting 0.5840–0.5800 support levels, aligning with broader downtrend structure. Sentiment: Bearish.

6.9K

#BTC/USD Market Analysis ₿📈 - #BTCUSD has printed a bullish candle around the 111,000 zone, showing renewed strength at key #Support after holding the consolidation range. - Buyers may attempt an upward continuation, with stops moved to breakeven for protection. #RSI indicates improving momentum. Sentiment: Bullish.

4.4K

#GBP/USD Market Analysis 💷 - #GBPUSD is developing a zigzag correction pattern on the 4H timeframe after a recent pullback. Key #Resistance at 1.35039 aligns with the week open price and #Fibonacci levels. - Price may see an impulsive upward continuation in wave (c) following lower timeframe buys. #RSI suggests building momentum. Bullish sentiment prevails.

3.8K

#XAU/USD Market Analysis 📉 - #XAUUSD is showing a strong bullish breakout after hitting support at 3458.3. Key #Resistance at 3495.4 aligns with recent highs and #Fibonacci levels. - Price may see a continuation upward toward 3495.4 if momentum holds. #RSI suggests bullish strength. Bullish sentiment dominates.

2.1K

#EUR/GBP Market Analysis 💷 - #EURGBP is forming a corrective wave (2) near 0.8630. Price is approaching #Support at 0.8641 with #Fibonacci at 78.6%. - Expecting a retest or consolidation around 0.8641. Sentiment remains bullish if price holds above 0.8590.

1.9K

#AUD/USD Market Analysis ⚠️ - Price is consolidating near key resistance with a wedge pattern forming. #RSI shows neutral momentum around 50. - Expecting a breakout attempt but high volatility increases uncertainty. Neutral sentiment until directional clarity emerges.

2K

#XAU/USD Market Analysis 📈 - #XAUUSD is forming an irregular flat in wave 4, with price holding above 3,320.000 key #Support. #MACD momentum shows early signs of recovery. - A breakout above 3,360.000 could trigger wave 5 towards higher #Resistance levels. Overall sentiment remains bullish.

2.1K

#EUR/USD Market Analysis ⚠️ - #EURUSD has broken below a short-term ascending trendline, signaling possible weakness. Price is trading under the #Resistance zone near 1.16590, showing rejection. - If selling pressure holds, a move toward 1.16080 support could follow. Sentiment is Bearish, but setup remains High Risk.

2.7K

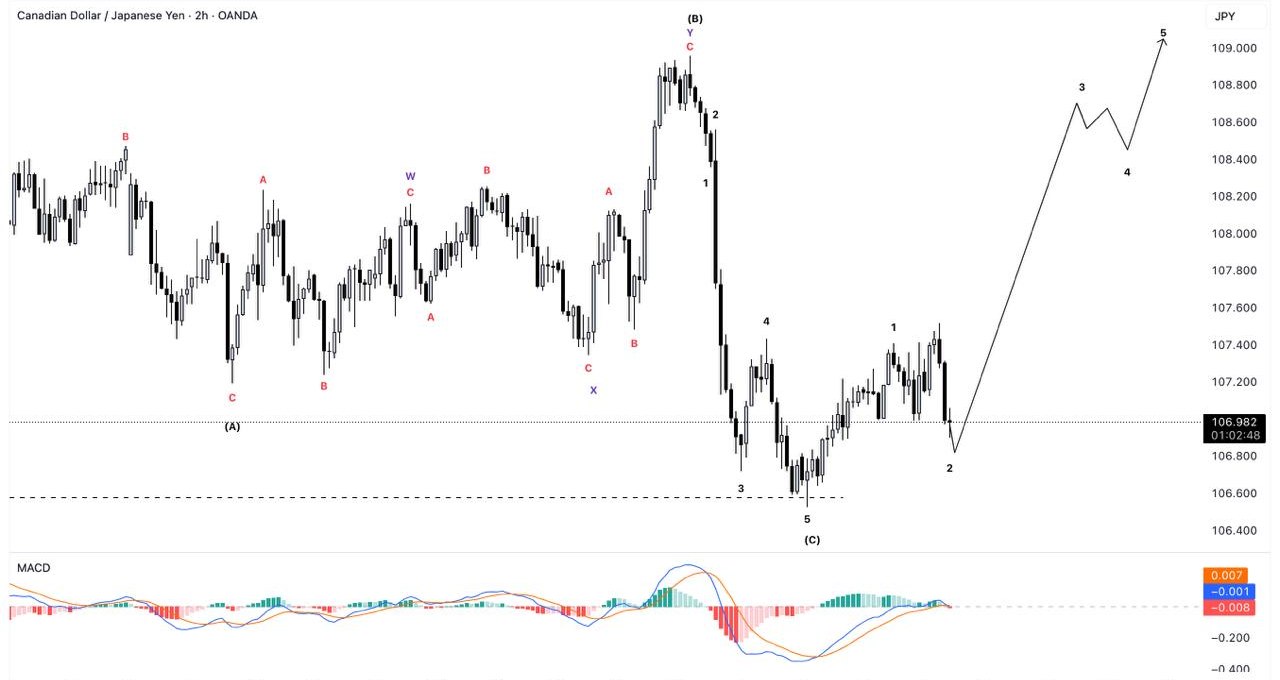

#CAD/JPY Market Analysis 🚀 - #CADJPY has completed a clean Elliott Wave ABC correction, with a possible Wave 2 bottom forming near 106.800. #MACD is showing early signs of bullish crossover, supporting upside potential. - A breakout from here could fuel Wave 3 toward the 108.600–109.000 region. Sentiment is Bullish as long as recent lows hold.

2.6K

#GBP/USD Market Analysis 📊 - #GBPUSD has broken above short-term resistance, forming a bullish structure on the 30-min chart. Price rebounded strongly from the #DemandZone near 1.2140, indicating buyer interest. - Price is now testing the previous consolidation zone, suggesting a possible bullish continuation. Current momentum and structure keep the sentiment bullish. #ForexAnalysis #PriceAction

2.3K

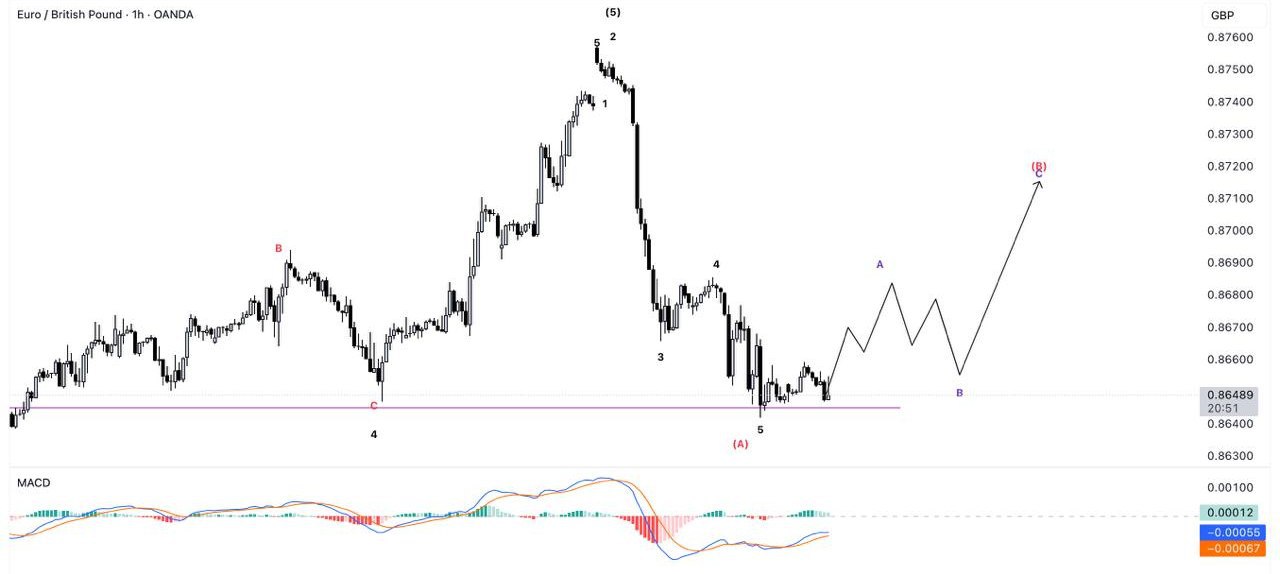

#EUR/GBP Market Analysis 🔁 - #EURGBP completed a 5-wave decline and is now forming an ABC corrective wave, indicating a potential Wave (B) bounce. MACD crossover also supports short-term upside momentum. - Price may climb toward 0.87100 after sub-wave B forms, but wave (B) is typically unpredictable and volatile. Sentiment is cautiously bullish, but best to wait for sub-wave confirmation.

2.8K

#EUR/USD Market Analysis 📉 - #EURUSD is showing bearish momentum after breaking below key structure. A return to the supply zone near 1.1700 – 1.1728 may trigger a reversal. - Watch for a bearish pin bar or doji at this zone. A break of the low could lead to further downside continuation. #ForexAnalysis #EURUSD

3.6K

#USD/JPY Market Analysis 🚀 - #USDJPY has completed a 5-wave falling wedge, with a bounce near the 61.80% #Fibonacci retracement, signaling a potential bullish reversal. Price action shows breakout intent. - A push above the 146.500 level may confirm a structure shift, with momentum supported by a strengthening #MACD crossover. Sentiment turning bullish as correction phase nears completion.

2.5K

#GBP/NZD Market Analysis 📊 - #GBPNZD is showing bearish momentum after failing to break resistance at 2.26800. Price is testing support at 2.25362, with further support around the 2.24609 level. - Expecting a potential pullback and retest of support. Bearish sentiment remains as long as 2.26800 holds.

2K

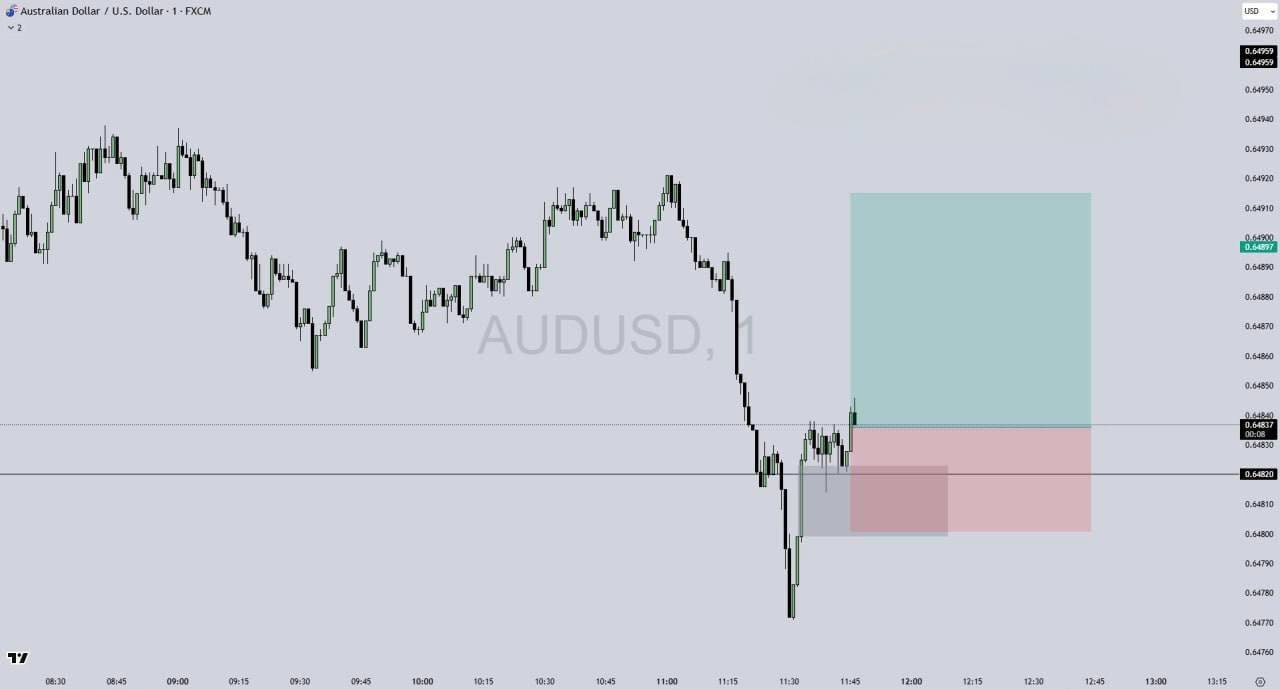

#AUD/USD Market Analysis 💹📉 - #AUDUSD is showing bearish momentum after breaking key support at 0.65845. The pair is reacting to #Fibonacci levels with further support at 0.65670 and 0.65401. - Expecting a continuation of the downward move, with #RSI indicating bearish pressure. Bearish sentiment remains as long as resistance holds at 0.65948.

1.8K

#XAU/USD Market Analysis 📈 #Gold is exhibiting bullish momentum after a rebound from the #SupportZone near 3311. The current move suggests a continuation toward resistance around 3332. Price is trading above key intraday levels, and the bullish #PriceAction is supported by rising #Momentum indicators. Sentiment: bullish.

1.7K

🪙 #Gold Liquidity Trap Setup #Gold may grab upside liquidity and show CHoCH with selling pressure. If confirmed, expect a pullback-driven drop as downside momentum builds. #XAUUSD #TradingAnalysis

1.4K

#USD/JPY Sell Limit Entry Point - 143.200 Profit Targets - 142.500, 139.00 Exit Point - 143.500 ------------------------ "Trade at your own risk. Prioritize money management: assess risk, set limits, and never invest more than you can afford to lose."

1.2K

#USD/CAD Buy Now Entry Point - 1.37610 Profit Targets - 1.38400 Exit Point - 1.34300 ------------------------ "Trade at your own risk. Prioritize money management: assess risk, set limits, and never invest more than you can afford to lose."

2.7K

#GBPUSD Bullish Momentum 📈 #GBPUSD made a 5-minute time frame Change of Character (ChoCH) from its pullback level, then pulled back and moved to the upside. The price action suggests a continuation of the bullish trend, with potential for further gains as the market shows signs of strength. Monitoring key levels for possible entry points and confirmation of the upward movement.

2.3K

#XAUUSD Breakout Watch 📈 #XAUUSD is consolidating in a sideways range on the 5-minute timeframe. A breakout from this range could trigger a significant move. No clear direction yet, but a decisive break above or below the range will likely set the tone. Watch for increased volume to confirm the breakout. Patience is key until the market reveals its next move. Stay cautious and monitor price action closely for potential opportunities.

1.8K

#XAU/USD Sell Limit ------------------------------- Entry: 3329 Targets: 3324, 3317 Stoploss: 3331 ------------------------------- "Trade at your own risk. Prioritize money management: assess risk, set limits, and never invest more than you can afford to lose."

1.6K

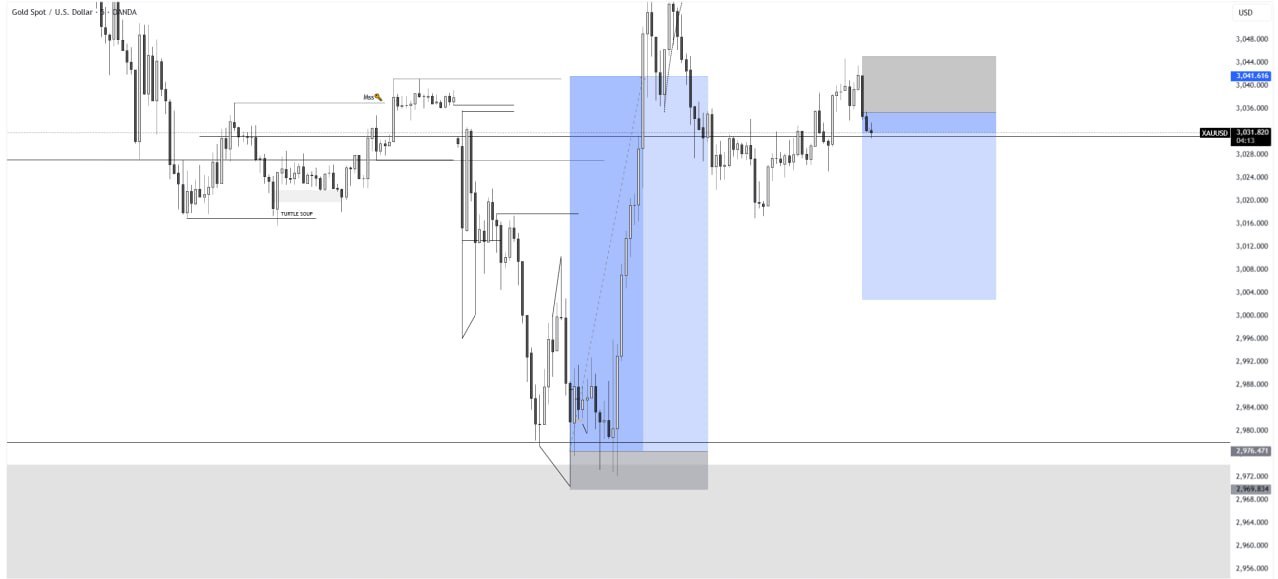

Pair: #XAUUSD Sell Limit ------------------------------- Entry: 3032 Targets: 3025 Stoploss: 3041 ------------------------------- "Trade at your own risk. Prioritize money management: assess risk, set limits, and never invest more than you can afford to lose."

2.4K

#EUR/JPY Buy Limit ------------------------------- Entry: 162.18 Targets: 162.84, 163.50 Stoploss: 161.88 ------------------------------- "Trade at your own risk. Prioritize money management: assess risk, set limits, and never invest more than you can afford to lose."

2.2K

Listing Statistics

7

10 hours ago

SeBuDA

Recently our headquarters moved from USA to Netherland so we could make more features for our users, we sure that our users can feel the changes in the future and this decision is for sake of our users

Netherland

Sebuda B.V.

CoC Number: 95490469

Zuid-Hollandlaan 7, 2596AL ‘s-Gravenhage

The Hauge, The Netherlands

(+31)0687365374

Be with us on Social Networks

Social media accounts for sale

Help and Services

© 2022 SeBuDA.com, All rights reserved.