Share to ...

Copy Link

Coen Bradley******rypto | 7.4K followers telegram account

1 months aged

@******rypto

Followers

7.4K

Posts

39

Price(USD)

$125

Category

Crypto

Date of Joined

Jan 2026

Date of Last Post

Jan 16, 2026

Last 36 posts

texts

2

Pictures

35

Videos

0

audios

0

documents

0

animations

0

Last 36 posts

Averages

Views

587

Post/Per Month

0

listing.TotalReactions

Total

1

Post/Per Month

Besties

💰 ETH ETFs see record inflows Ethereum spot ETFs attracted $2.85B last week – five times more than BTC ETFs in the same period. Total assets now stand at $28B. ➡️ Biggest weekly inflow since launch ➡️ Clear signal of growing institutional appetite ➡️ ETH gaining ground over BTC in TradFi interest The tide is shifting.

666

Top 10 Hashtags

No Data

Description

🔥 Premium Telegram channel Category : Crypto & Trading & Forex ─ The channel has many promoted posts that can be changed to suit your needs. _ The channel has stable high quality followers. ✔️ Channel never violated any rules, no restrictions or bans on it. ✅ It's your ideal choice to start or promote your business. ✔️ Full transfer of the channel to your TG account, you will be the sole abd full owner. ⚡ Instant Delivery ⚡

Last Posts

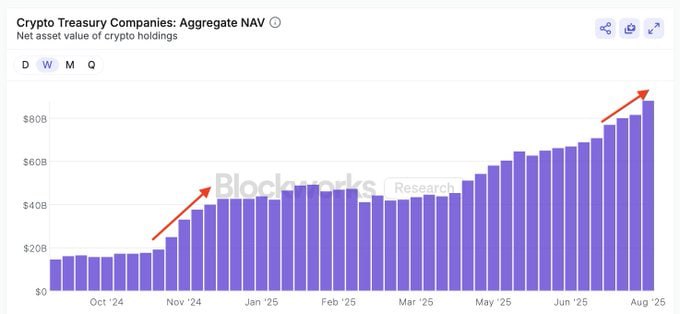

🏦 Crypto treasuries stack $18B since June Corporate treasuries have added $18B in crypto holdings in just two months - a pace we haven’t seen before. ➡️ Structural demand, not short-term speculation ➡️ Steady climb since last year, now accelerating ➡️ Signals deeper integration of crypto into balance sheets When companies start hoarding, the game changes.

483

🔥 First billion-dollar daily inflow into $ETH just hit • BlackRock’s ETHA pulled in +$639.8M • Fidelity’s FETH added +$276.9M • The rest of the pack brought the total to +$1.018B Over the weekend, $SBET and $BMNR, the TradFi ponzi shops of choice, were buying aggressively into empty order books. $BMNR, run by Tom Lee, even doubled MicroStrategy’s trading volume yesterday: $8.6B vs $4.09B TradFi has picked its new toy, and right now it’s speculating on Ethereum treasuries. The difference this time? These aren’t degens - they’re desks with billions to burn. If the flows keep up, $ETH stops being a “tech trade” and starts acting like a liquidity black hole.

484

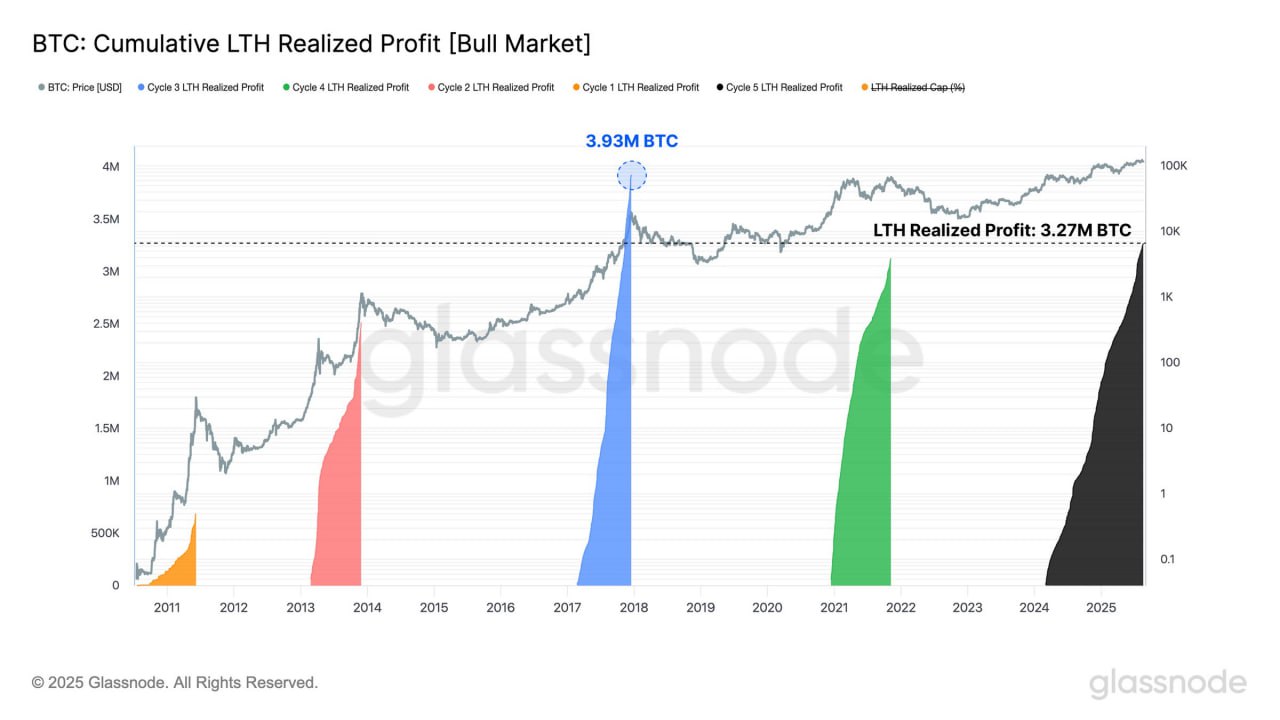

📊 BTC long-term holders cashing out Glassnode data shows long-term holders have already realized more profit this cycle than in nearly every previous one - only 2016–17 was higher. ➡️ LTH realized profit this cycle: 3.27M BTC ➡️ Peak of 2017 cycle: 3.93M BTC ➡️ Elevated profit-taking = higher sell-side pressure ➡️ Signals align with late-phase cycle behavior When the old coins move, it usually means the easy part of the cycle is over.

505

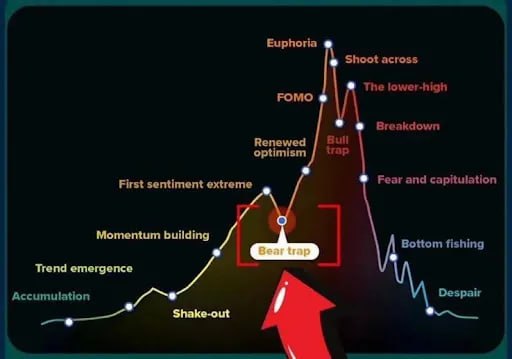

📈 Why market cycle psychology works every time Every chart looks different, but the emotions behind the moves never change. From disbelief to euphoria and back to despair — the cycle plays on repeat, fueled by retail psychology and smart money timing. ➡️ Greed blinds traders near the top ➡️ Panic forces exits near the bottom ➡️ “This time is different” always comes too late ➡️ Institutions sell strength and buy fear ➡️ Retail does the opposite — every cycle If you want to win, trade the emotions, not the chart. Mastering cycles means mastering human nature.

1

510

511

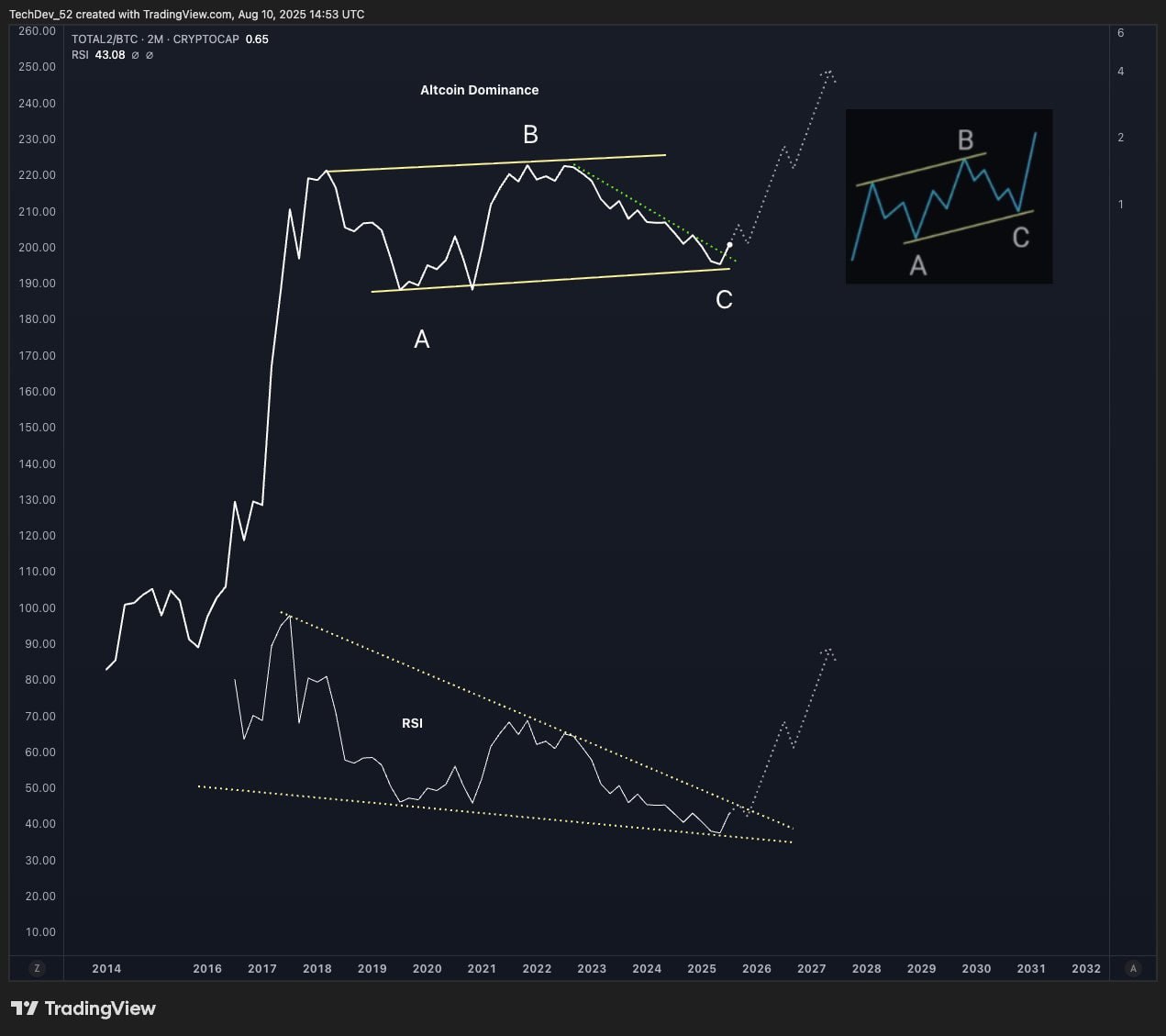

‼️ Altcoin dominance may be breaking out of a 7-year correction. The 2021 rally? Possibly not even the real move. If this 7-year RSI wedge plays out, alts could be entering their first true impulsive run in 8 years.

515

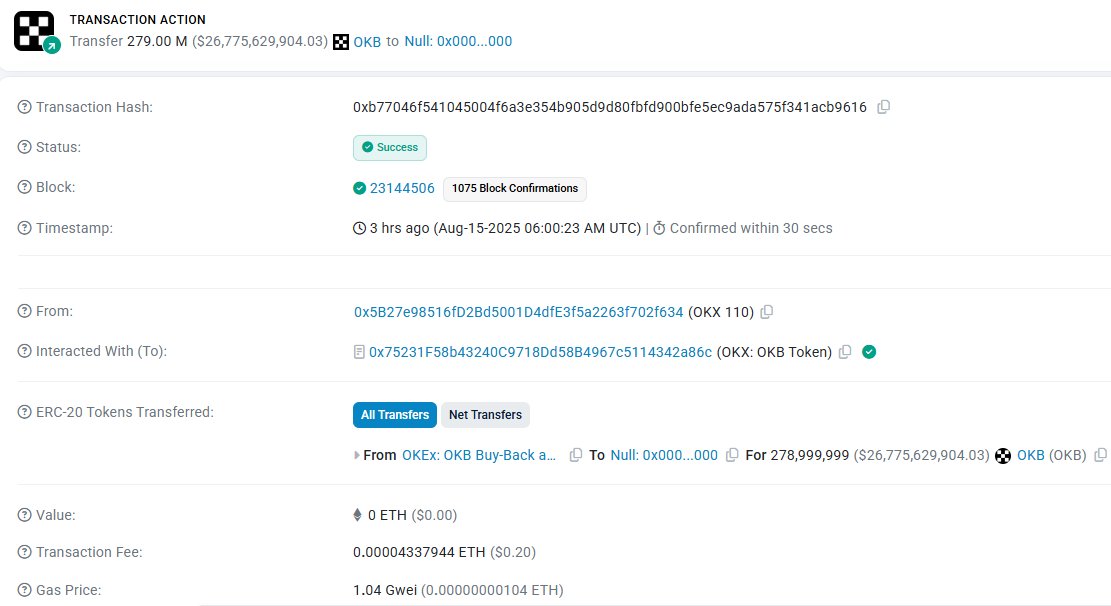

JUST IN: OKX has permanently burned 278,999,999 OKB tokens, valued at more than $26 billion at current prices.

516

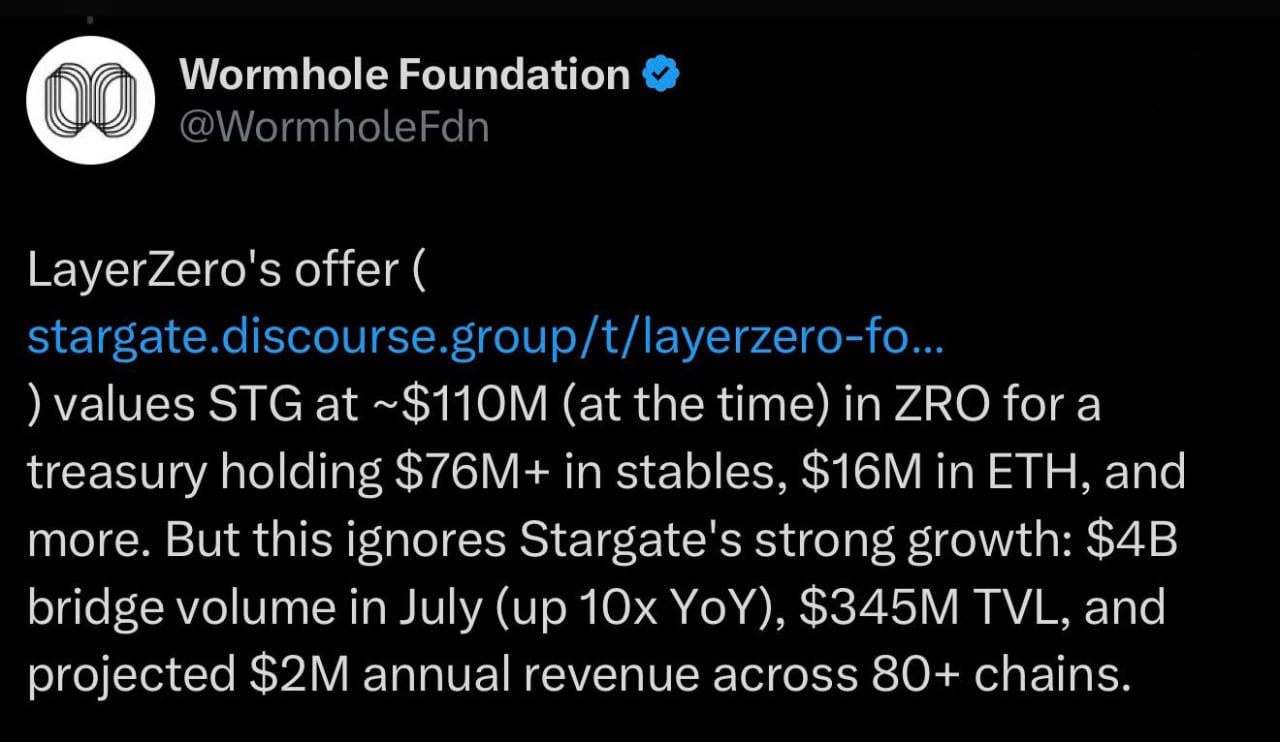

🪐 Wormhole Challenges LayerZero Over Stargate Wormhole Foundation plans to submit a “significantly higher bid” for Stargate ($STG), calling the project undervalued. ➡️ LayerZero has already offered $110M in $ZRO tokens ➡️ Wormhole says it will top that figure ➡️ The foundation asked for a 5-day pause in Snapshot voting to finalize its offer A bidding war could decide Stargate’s future and reshape the cross-chain landscape.

520

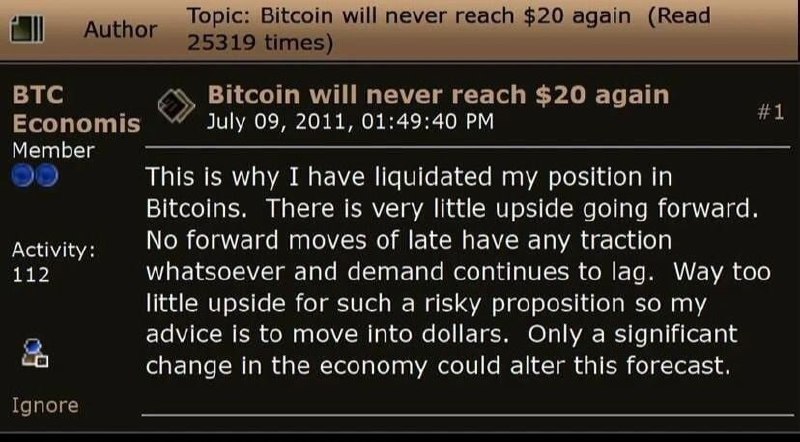

🔹 "Never reaching $20" aged like milk Some calls are so bad, they become historic.

541

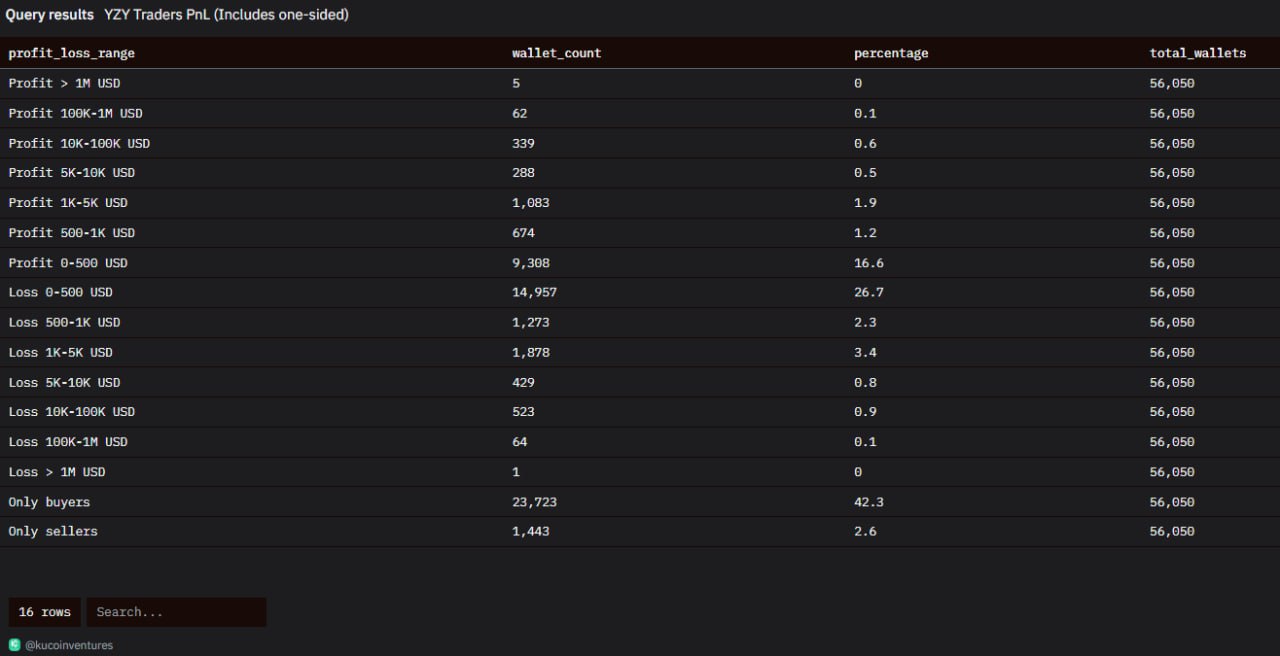

📉 $YZY traders wrecked. 56,050 wallets touched the token: ➡️ 14,957 lost up to $500 ➡️ 1,273 lost $500–$1K ➡️ 1,878 lost $1K–$5K ➡️ 429 lost $5K–$10K ➡️ 523 lost $10K–$100K ➡️ 64 lost $100K–$1M ➡️ 1 lost $1M+ Meanwhile, only 5 wallets made $1M+. Total bloodbath.

541

JUST IN: Webull is ready to restart cryptocurrency trading services for U.S. customers.

541

JUST IN: ETH just surpassed $4,400!

542

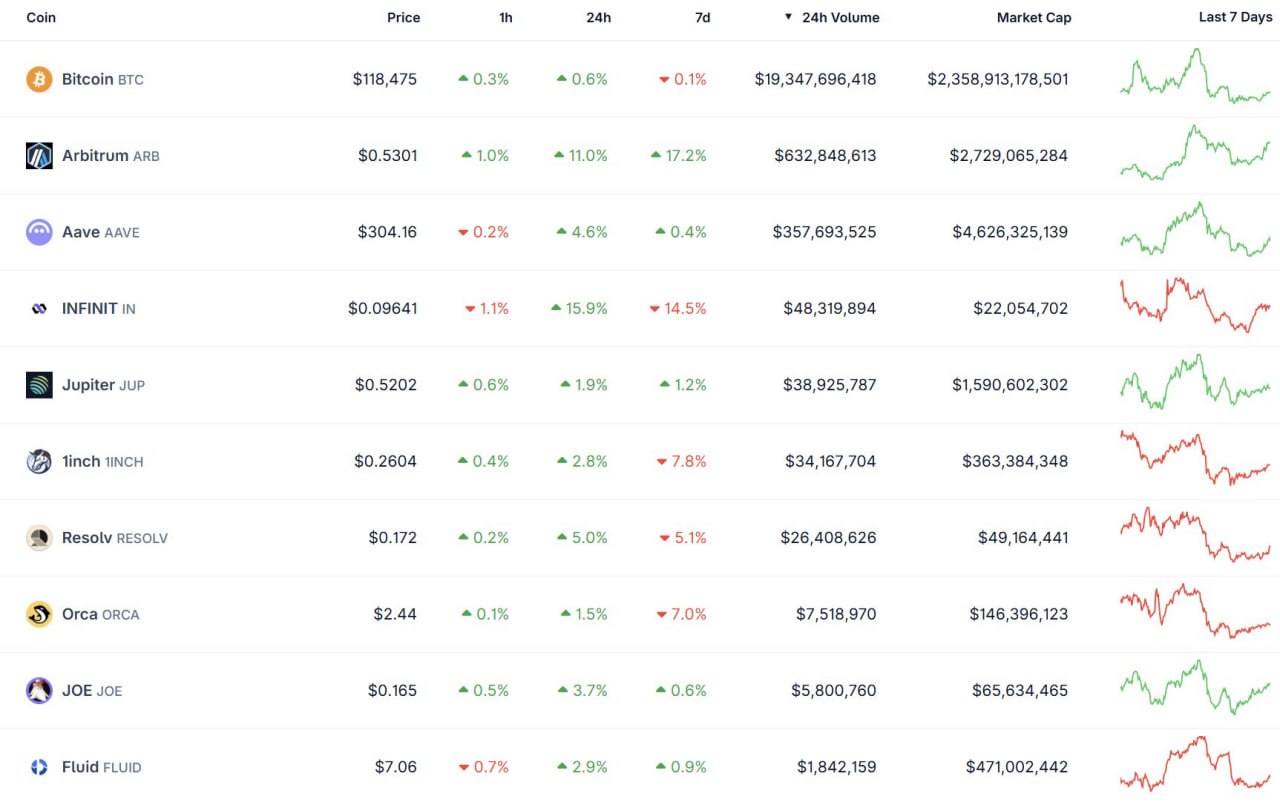

📄 Crypto Watchlist for this week: ➡️ $AAVE – will get 7% of WLFI supply, worth $1B+ at pre-market prices ➡️ $JUP $FLUID – Jupiter Lend launches on Solana in August ➡️ $RESOLV – fee switch rollout completes Aug 21 ➡️ $BTC – Brazil Parliament debates national Bitcoin reserve Aug 20 ➡️ $ARB – Arbitrum buildathon starts Aug 22 ➡️ $IN – INFINIT V2 public beta goes live in coming days ➡️ $JOE – LFJ (ex-Trader Joe) releasing new token launcher on Solana next week ➡️ Cap Money – launches on Ethereum L1 Aug 18, big MegaETH hype ➡️ $ORCA $1INCH – joint announcement teased for Aug 19 ➡️ Powell speech + FOMC Minutes on Aug 20 Plenty of catalysts lined up, positioning matters.

542

Rules for the bull 👇 ➡️ Always have an exit plan ➡️ Take profits instead of screenshots ➡️ Don't sell winners to buy losers ➡️ Keep an eye on the token unlocks ➡️ Make only high-conviction bets The hardest part is not making money, but sticking to a plan and keeping it.

543

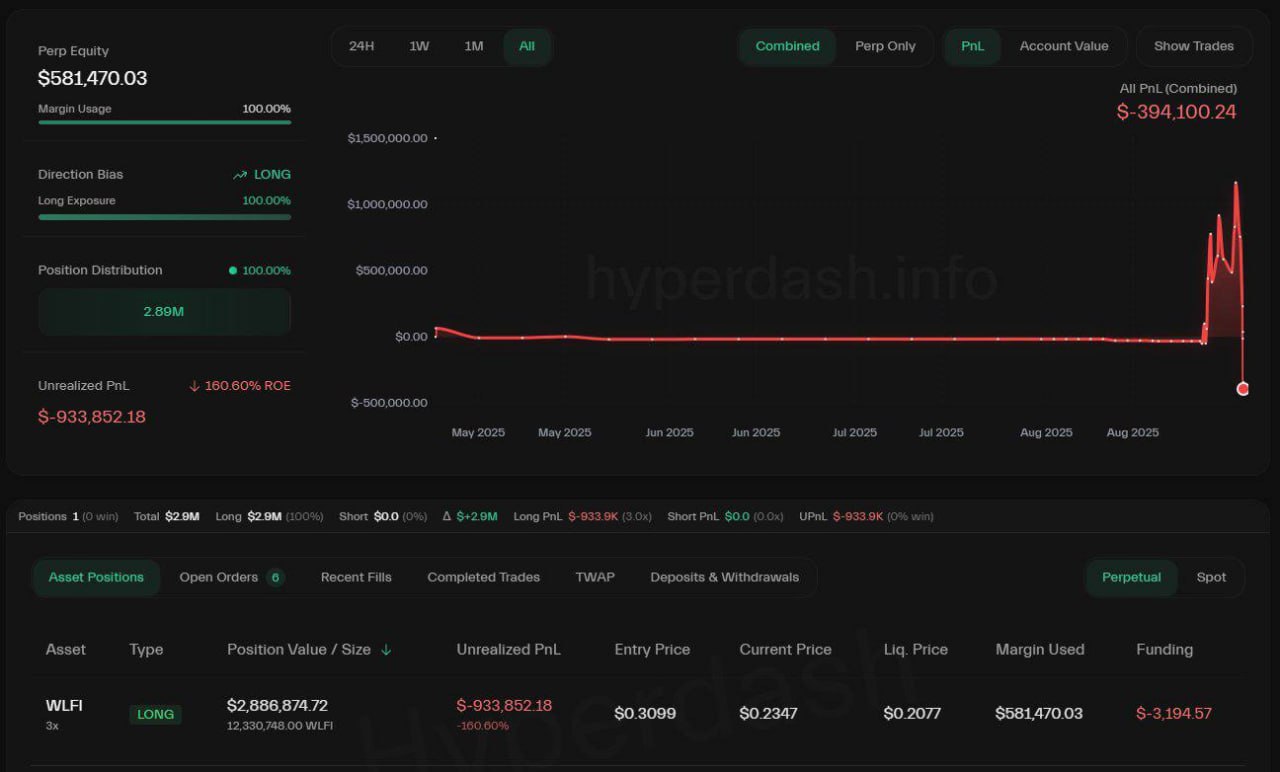

🔽One trader’s $WLFI FOMO spiral This wallet closed its $WLFI long with a $915K profit. A clean exit. Then FOMO hit. He jumped back in with 3x leverage. Now he’s sitting on a $930K unrealized loss. In bull markets, the hardest trade is often to do nothing.

549

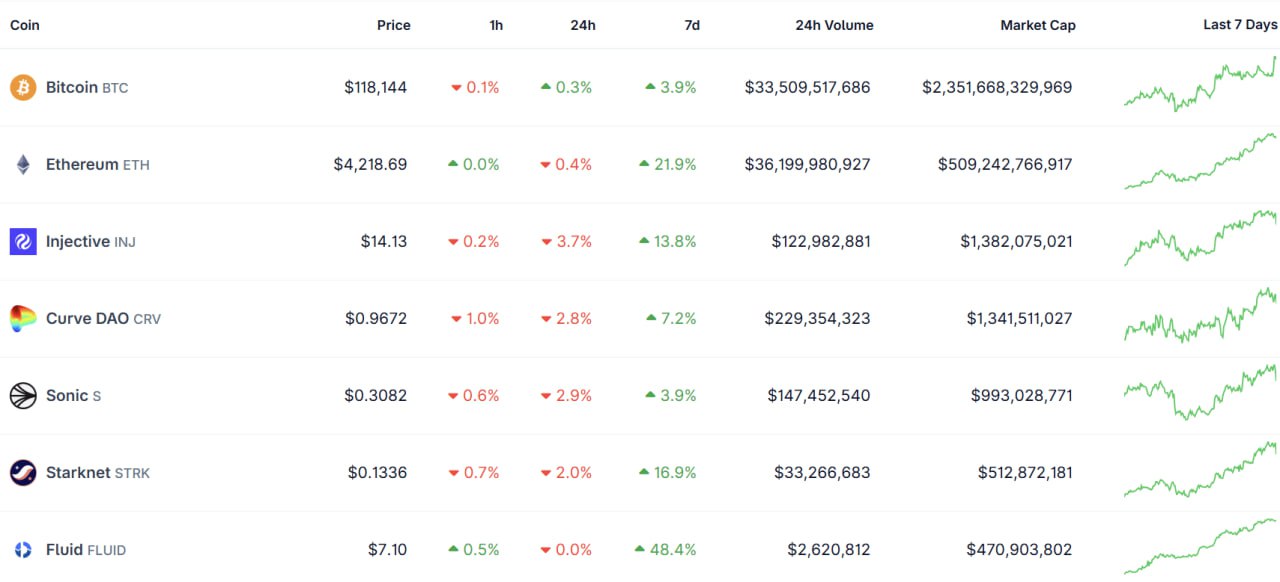

📄 Crypto Watchlist for this week: ➡️ $BTC – FTX to distribute $1.9B in cash to creditors on Aug. 15 ➡️ $FLUID – Buyback proposal expected to go live next week ➡️ $ETH – Sharplink Gaming earnings call on Aug. 15 ➡️ $CRV – Emissions rate dropping below 5% next week ➡️ Lombard – LBTC starts accruing BTC yield on Aug. 11 ➡️ $S – Public treasury companies eyeing Sonic's S token ➡️ $INJ – Pre-IPO stock trading launch coming soon ➡️ Macro – US CPI release on Aug. 12 ➡️ $STRK – Vote on Bitcoin Staking on Starknet starts tomorrow

574

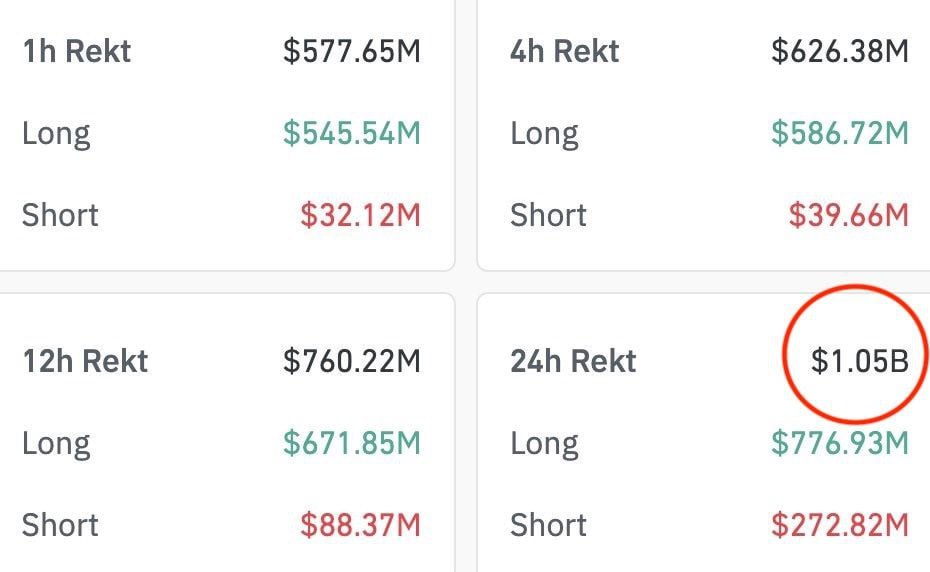

JUST IN: Over the past 24 hours, there have been liquidations exceeding $1 billion in Bitcoin and other cryptocurrencies.

576

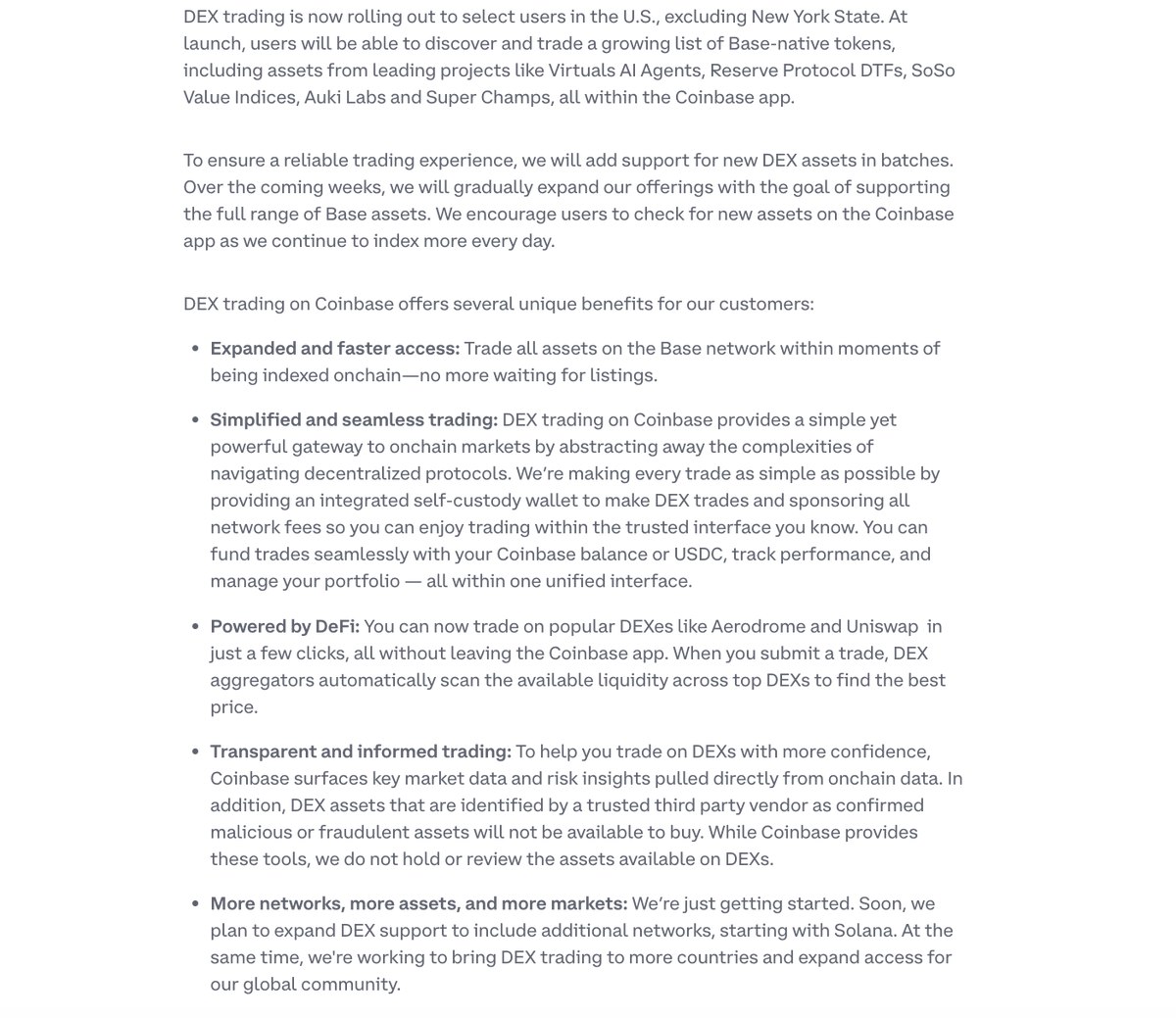

JUST IN: Coinbase announces that "DEX trading is now available to select users in the U.S., excluding New York State. At launch, users can discover and trade a growing list of Base-native tokens."

578

❕1064 days. That’s the pattern. Both previous Bitcoin bull runs peaked exactly 1064 days after the bottom. We're 10 weeks away from that number. ➡️ Cycle 1: 1064 days ➡️ Cycle 2: 1064 days ➡️ Cycle 3: hits 1064 in October If it rhymes again — top is near.

582

🚨🚨🚨 JUST IN : Eric Trump retweets about Strategic Bitcoin Reserve and immediately deleted it. | link

583

The sentiment 😃

586

💧 Bitcoin as a liquidity sponge BTC’s price has been closely tracking global M2 money supply - not perfectly, but enough to show the link. You don’t need to nail the exact overlay to see the bigger picture: follow global liquidity, and you’ll usually be a step ahead of Bitcoin’s next major move.

587

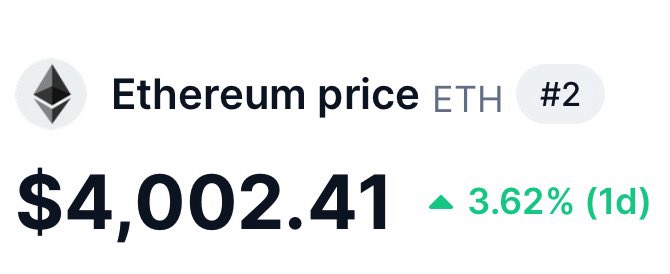

JUST IN: The price of Ethereum (ETH) has surpassed $4,000.

588

JUST IN: Michael Saylor has shared the Saylor Bitcoin tracker once more, hinting that a new BTC acquisition announcement by Strategy might be imminent.

589

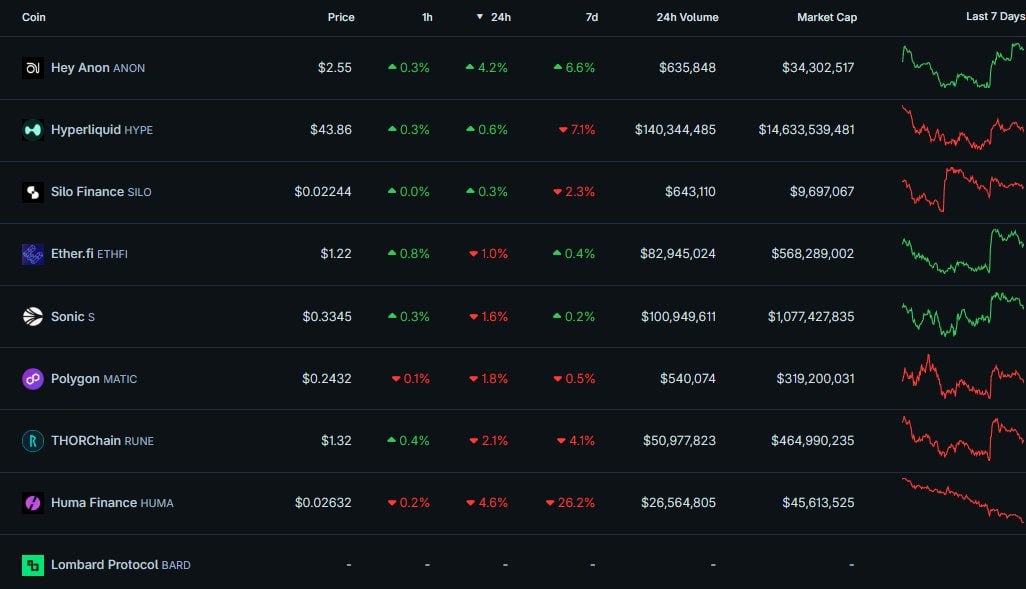

📄 Crypto Watchlist for this week: ➡️$HYPE $ETHFI - EtherFi will soon launch perps powered by Hyperliquid ➡️$S - Voting for Sonic's proposal to create a Sonic USA entity and launch an $S ETF ends on Aug. 31 ➡️$SILO - Silo Finance's proposal to distribute 50% of its revenue as USDC to xSILO holders looks like it will pass today ➡️$ANON - Daniele Sesta announced that HeyAnon 1.0, the biggest protocol upgrade so far, will be released next week ➡️$HUMA - 21% of Huma Finance's HUMA circulating supply will be unlocked on Aug. 26 ➡️$LINEA - Linea airdrop checker is rumored to be launched next week ➡️$BARD - Lombard's BARD community sale starts next week ➡️$POL - Polygon CEO will do an AMA revealing the project's roadmap next week ➡️$RUNE - The next major THORChain upgrade happens next week ➡️AI coins - NVIDIA earnings call is scheduled for Aug. 27 ➡️Macro events - China is considering approving yuan-backed stablecoins this month according to Reuters

589

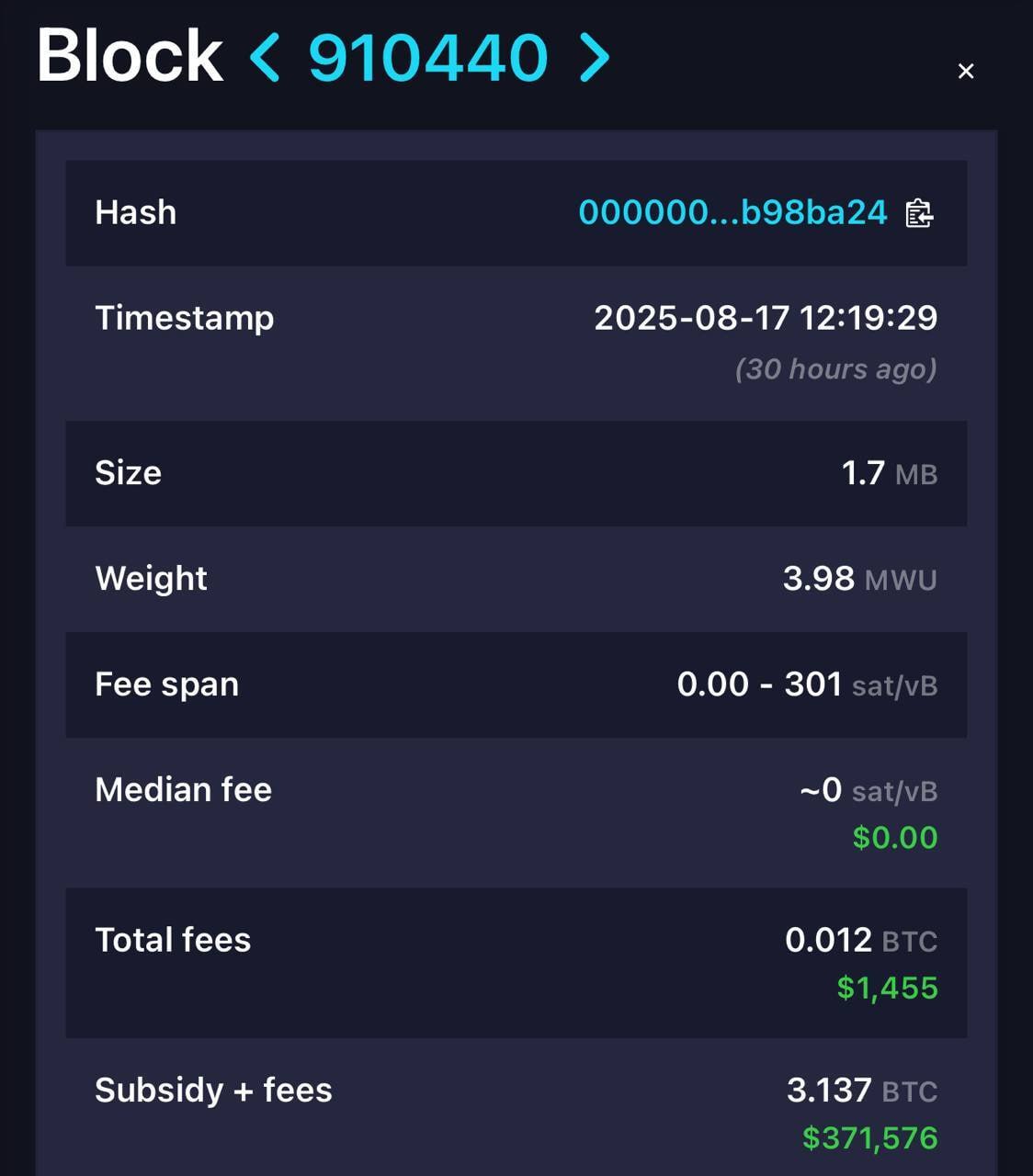

🪙 A solo Bitcoin miner has mined a block, earning 3.17BTC ($371K)

591

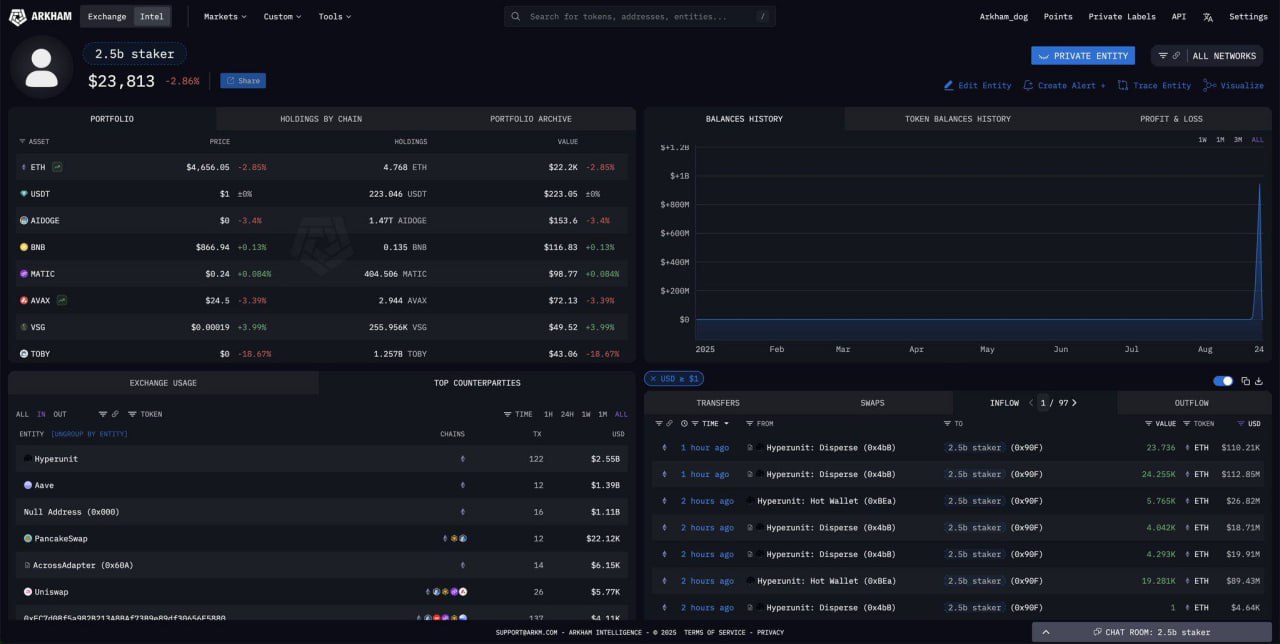

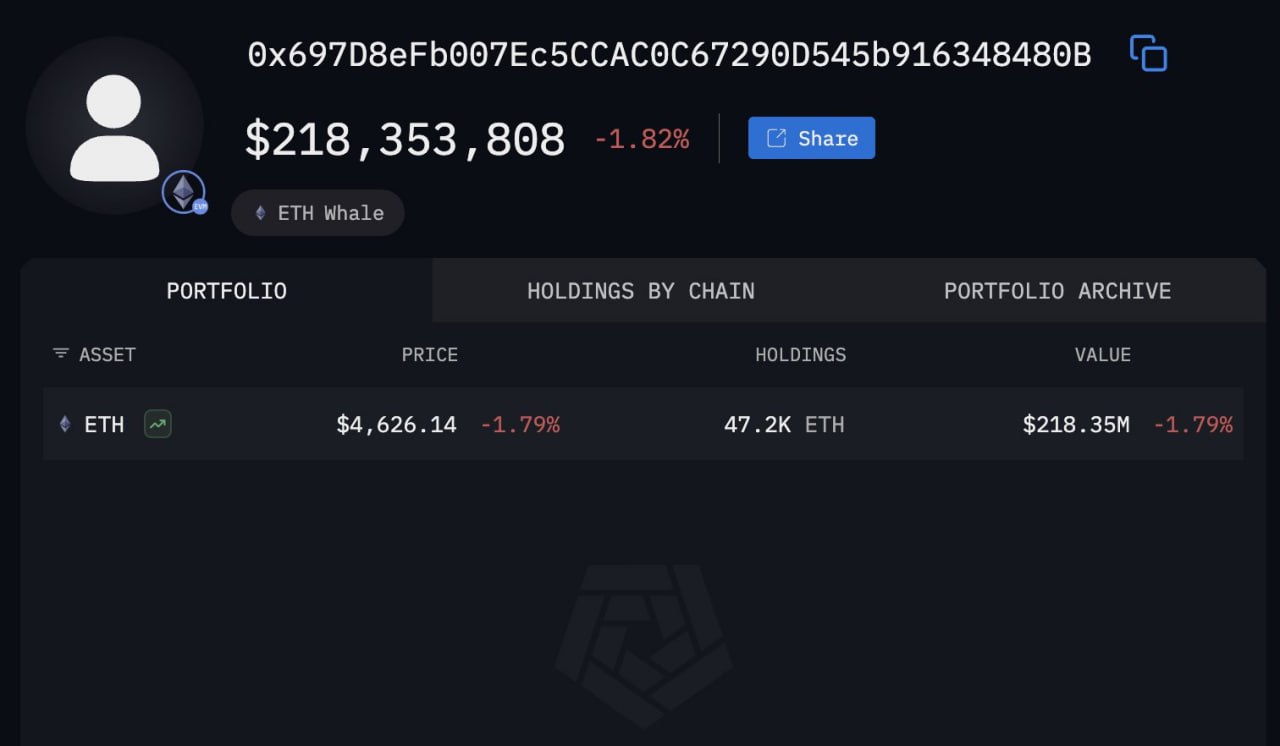

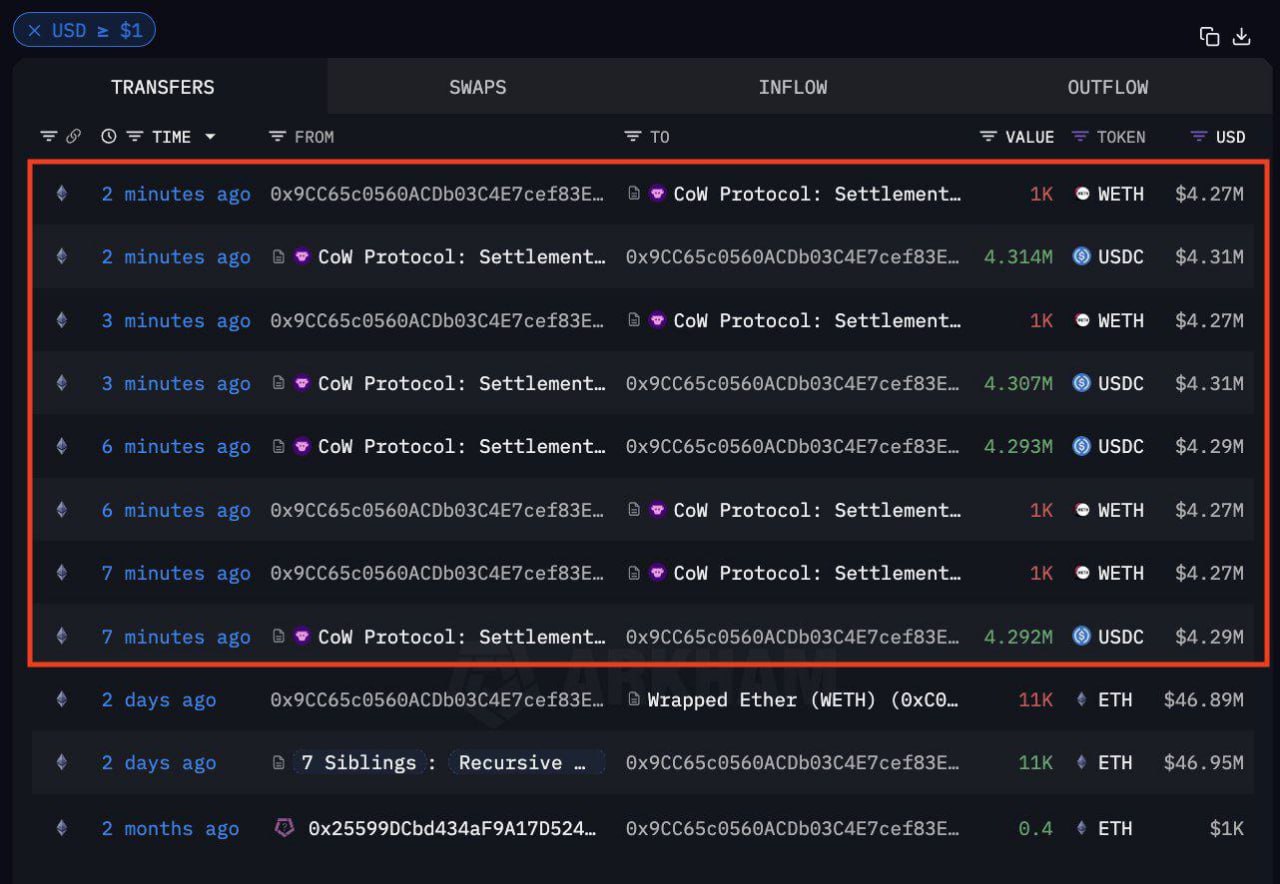

🐋 Whale stakes $285M in ETH A new wallet pulled 60,000 ETH ($284.76M) from Coinbase Prime and started staking. ➡️ 3,200 ETH ($14.75M) sent to 4 different wallets ➡️ One already deposited to Coinbase Staking Fresh money, long-term lockup - bullish signal hiding in plain sight.

592

596

📊 Tokens with outsized liquidity These names have some of the highest trading volume relative to their market cap - meaning money is moving through them fast: ➡️$FARTCOIN – 0.36x ➡️$LDO – 0.33x ➡️$ENA – 0.23x ➡️$WIF – 0.22x ➡️$PENGU – 0.22x ➡️$PUMP – 0.22x High relative volume can signal strong market interest, short-term volatility, and better trade execution. It’s not a buy signal on its own - but these are the tickers where liquidity gives you room to act.

603

JUST IN: $PEPE has exceeded a $5.2 billion market cap due to increasing bullish momentum.

604

🪙 Saylor posted the new Bitcoin tracker

621

📈 Gold vs Bitcoin divergence Gold and Bitcoin have been moving almost tick for tick for the past three years. Both seen as hedges against fiat debasement, both reacting to liquidity. Now the correlation has broken. Gold is making new highs while Bitcoin is dumping. ➡️ Historically, such divergences don’t last long ➡️ Either Gold is leading a macro bid, or Bitcoin is flashing a warning ➡️ The odds favor Gold - it rarely “lies” in these setups A resolution is coming. When it snaps back, it won’t be quiet.

622

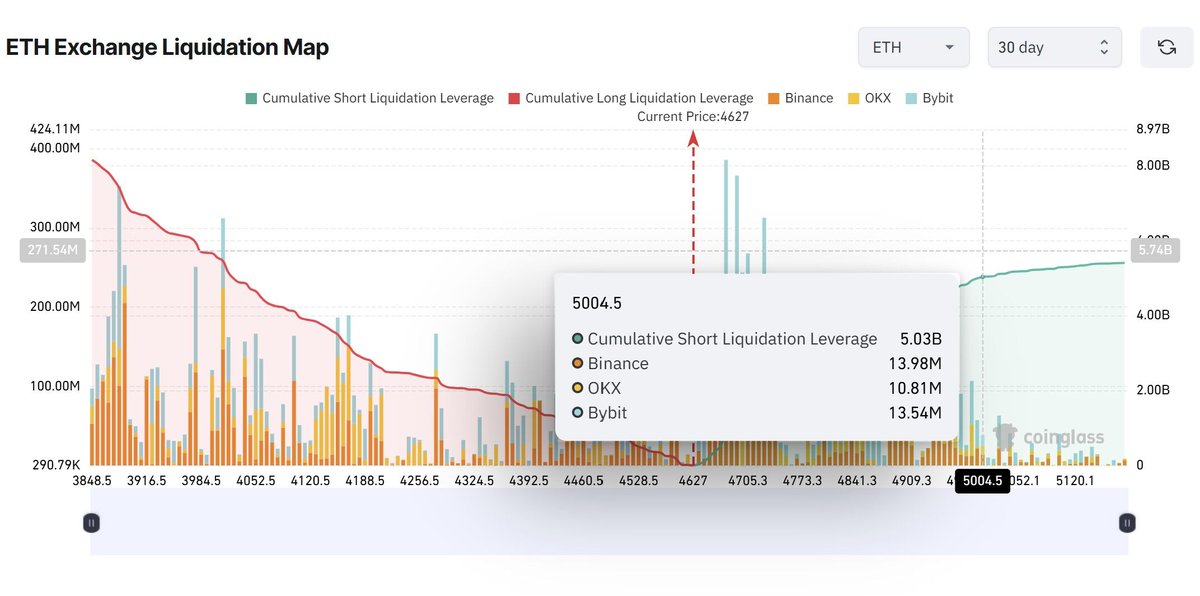

JUST IN: More than $5 billion in short positions could be liquidated if Ethereum's price reaches $5,000.

626

⚠️ HashFlare founders given time served for $577M crypto Ponzi — "largest fraud case in the Seattle court’s history" The pair were arrested in Estonia in November 2022 and spent 16 months in custody before being extradited to the US in May 2024, where they pleaded guilty to conspiracy to commit wire fraud.

637

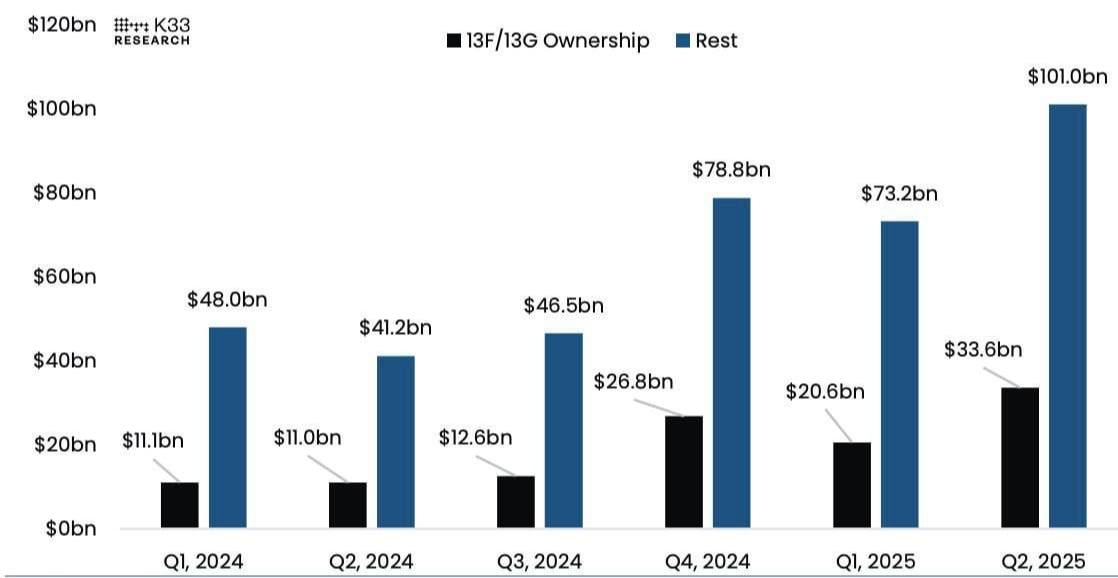

🪙 Spot Bitcoin ETFs surged to a record $134.6 billion in Q2

651

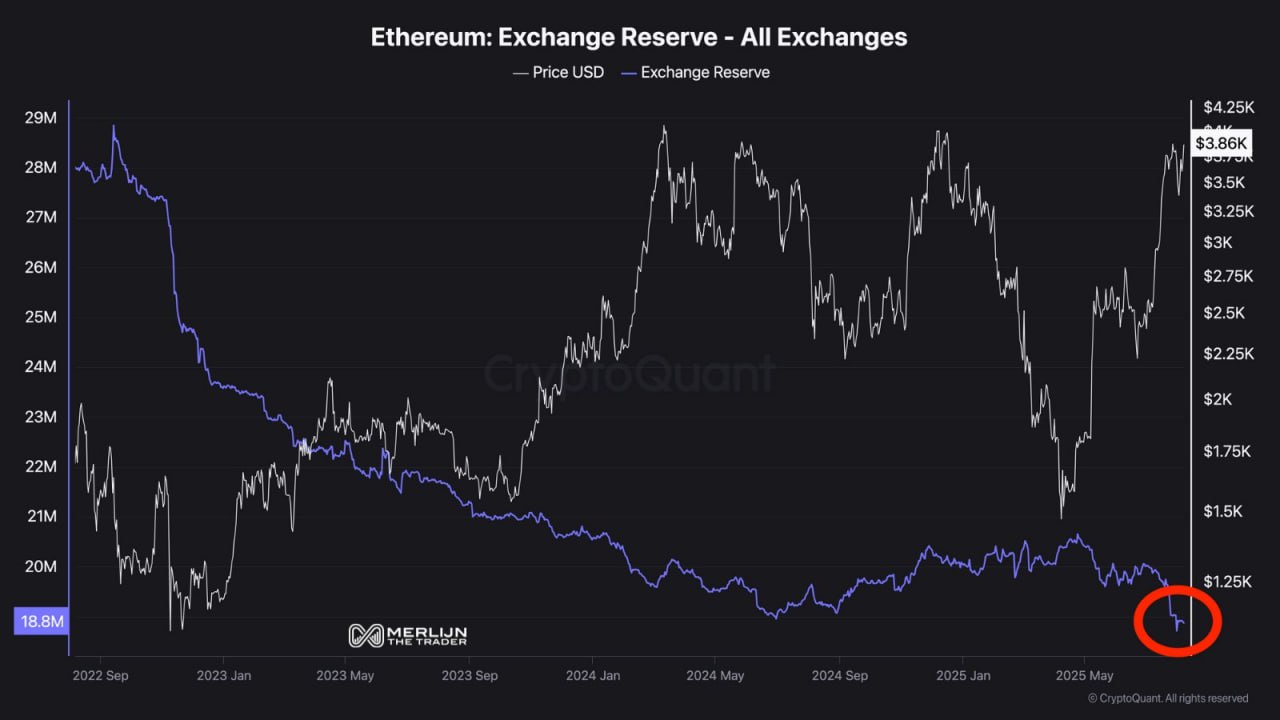

📉 ETH reserves hit record lows Only 18.8M $ETH left on exchanges – the lowest since tracking began. Supply continues to dry up while demand (ETF flows, staking, smart money) grows. If spot demand accelerates, the runway gets vertical.

661

💰 ETH ETFs see record inflows Ethereum spot ETFs attracted $2.85B last week – five times more than BTC ETFs in the same period. Total assets now stand at $28B. ➡️ Biggest weekly inflow since launch ➡️ Clear signal of growing institutional appetite ➡️ ETH gaining ground over BTC in TradFi interest The tide is shifting.

666

SeBuDA

Recently our headquarters moved from USA to Netherland so we could make more features for our users, we sure that our users can feel the changes in the future and this decision is for sake of our users

Netherland

Sebuda B.V.

CoC Number: 95490469

Zuid-Hollandlaan 7, 2596AL ‘s-Gravenhage

The Hauge, The Netherlands

(+31)0687365374

Be with us on Social Networks

Social media accounts for sale

Help and Services

© 2022 SeBuDA.com, All rights reserved.